Ecommerce Financial Model Calculator: Navigate Your Business to Success

In the fast-paced world of e-commerce, understanding and managing your financials is the key to unlocking growth and sustainability. Fiscra introduces a groundbreaking tool for online entrepreneurs: the Ecommerce Financial Model Calculator. This intuitive tool is designed to simplify complex financial planning, giving you the insights needed to steer your business toward profitability and success.

Why Our Calculator is a Must-Have for Your Ecommerce Business

Our Ecommerce Financial Model Calculator is more than just a digital tool; it’s a strategic partner in your e-commerce journey. Here’s why it’s indispensable:

Real-Time Projections: Instantly generate sales, revenue, and cash flow forecasts based on your input, helping you plan with precision.

Cost and Profit Analysis: Dive deep into your expenses and profit margins to identify areas for optimization and growth.

User-Friendly Interface: Designed with ease of use in mind, our calculator allows you to input data and get results without any prior financial expertise.

Key Features of the Ecommerce Financial Model Calculator

Customizable Inputs: Tailor the calculator to your specific business model by adjusting variables like average order value, conversion rate, and overhead costs.

Dynamic Forecasts: See how changes in your business strategy can impact your financial outlook with dynamic, real-time modeling.

Comprehensive Reporting: Access detailed reports on your financial performance, including break-even analysis, profit and loss statements, and more.

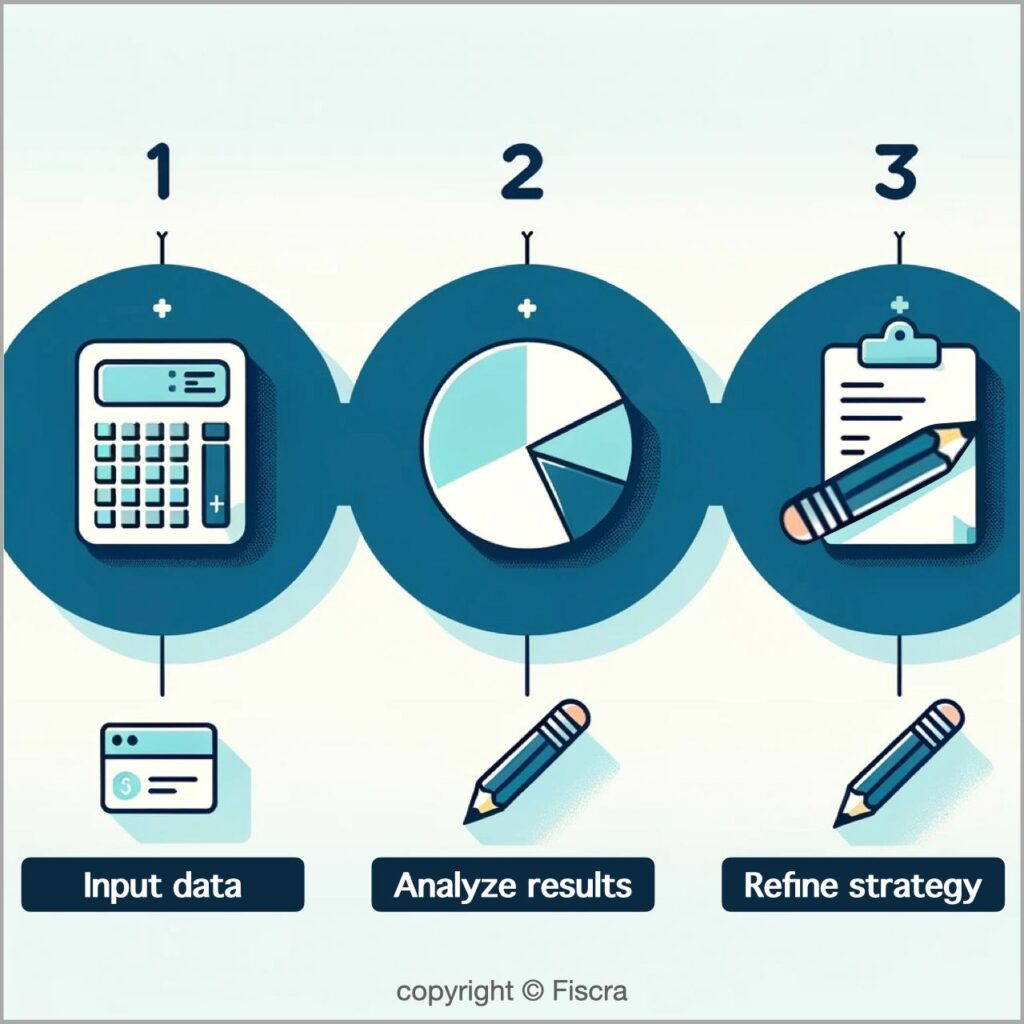

How to Use the Calculator to Empower Your Ecommerce Strategy

Utilizing the Ecommerce Financial Model Calculator is straightforward and impactful. Here’s how it can transform your financial planning:

Step 1: Input Your Data: Start by entering your current financials and assumptions about your ecommerce business.

Step 2: Analyze the Outcomes: Review the calculator’s projections to understand your business’s financial trajectory.

Step 3: Strategize for Growth: Use the insights gained to refine your business model, optimize your costs, and plan for future expansion.

Conclusion

The Ecommerce Financial Model Calculator by Fiscra is your pathway to informed decision-making and strategic financial planning in e-commerce. By providing a clear view of your business’s financial landscape, it empowers you to make data-driven decisions that drive growth and profitability. Explore the tool today and take the first step towards transforming your e-commerce business’s financial future.

Crafting a Financial Strategy with an Ecommerce Financial Plan Calculator: Step-by-step Guide

Navigating the financial intricacies of an e-commerce business can be challenging but crucial for its success. An e-commerce financial model calculator provides a structured method to analyze and forecast the financial performance of an online store. Here’s a guide on how to utilize this calculator to its full potential:

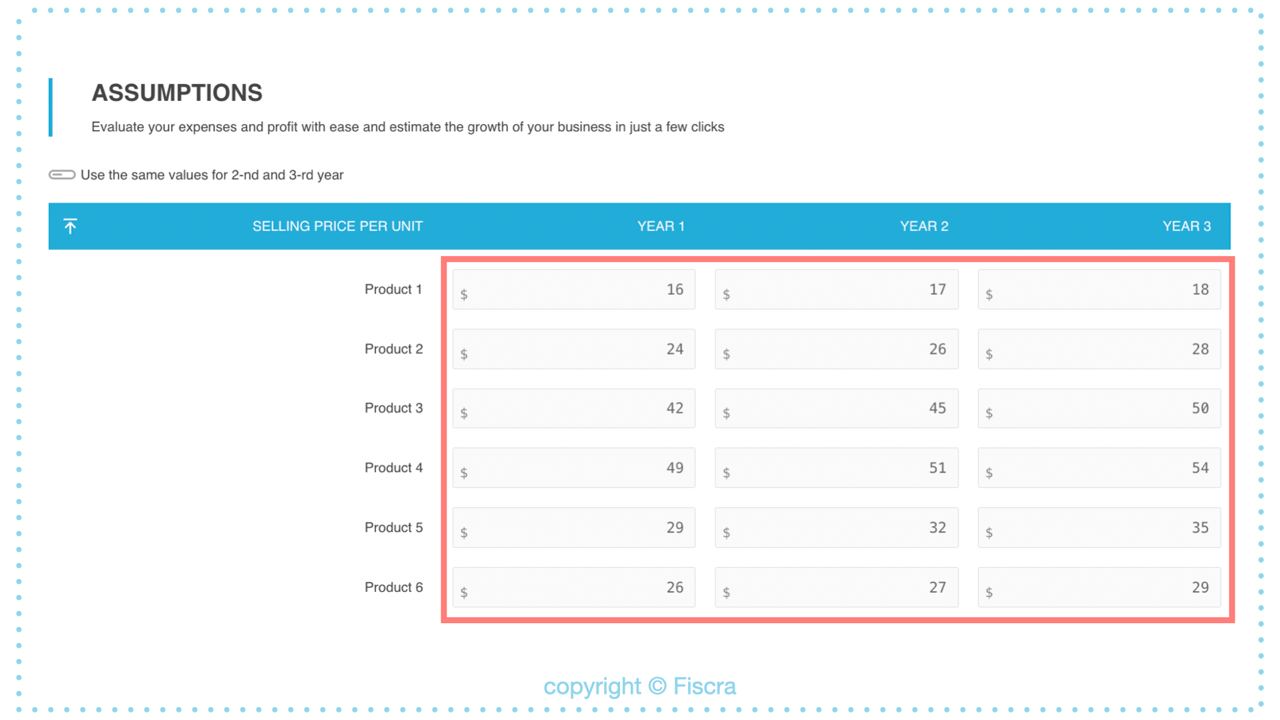

Step 1: Input Prices

Initiate the process by listing your e-commerce offerings, categorizing them into 6 of the most popular groups, etc. Assign a price to each item or category to establish the revenue framework, setting the stage for an income estimation based on your pricing strategy.

=> If you use ‘category‘ items, input average prices for each of them.

=> This financial model enables the creation of a 3-year financial forecast. Select “Use the same values for 2-nd and 3-rd year” for easier data entry if consistent data is expected.

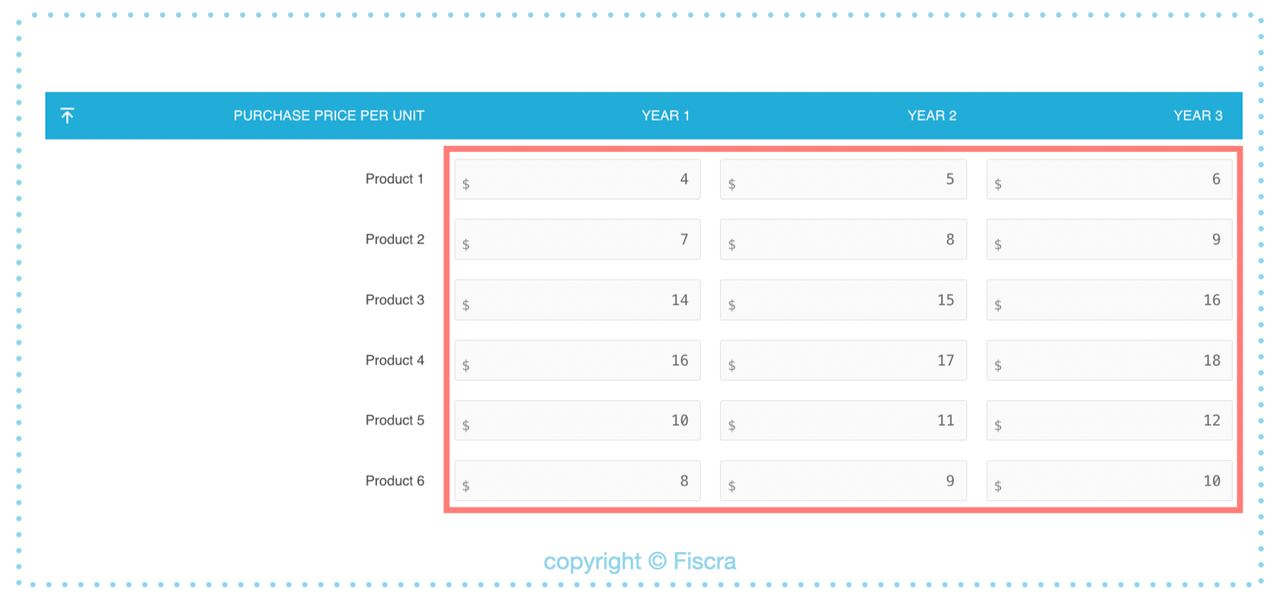

Step 2: Determine Cost of Goods Sold (COGS)

Input the COGS for each product category, which includes costs related to procurement (purchase price), packaging, and direct fulfillment expenses. Accurately assessing COGS is essential for evaluating the gross margin and the cost-effectiveness of your product assortment.

Step 3: Add Sales Volume

Project the anticipated sales volume for each category or item, considering factors like market trends, seasonality, and promotional activities. Precise sales forecasting is critical for calculating expected revenue and planning inventory levels.

Step 4: Sale Commissions and Discounts Calculation for Ecommerce Financial Model

Incorporate any sale commissions or discounts as a percentage of retail prices, affecting net profit. This step is crucial for accurately projecting net profit after accounting for promotional discounts or third-party sales commissions and all other expenses.

Step 5: Determine Main Operating Expenses for your Ecommerce Financial Plan

Document all recurring expenses associated with running your e-commerce platform, such as web hosting fees, marketing and advertising costs, staff salaries, and technology upgrades. A thorough accounting of operating expenses is necessary for a comprehensive financial analysis.

Step 6: Calculate Initial Investments for Ecommerce Financial Model

Estimate the initial capital needed to launch or expand your e-commerce operation. They can include:

- Website Development and Design: Costs associated with creating a professional e-commerce website, including web design, development, hosting, and domain registration.

- Inventory Purchases: Initial capital required to acquire stock for the products you plan to sell on your e-commerce platform.

- Market Research: Expenses related to conducting market research to understand your target audience, competition, and market demand.

- Payment Processing Setup: Fees associated with setting up payment gateways and processing capabilities to accept customer payments online.

- Legal Fees and Licenses: Expenses for obtaining necessary business licenses, trademarks, and legal consultations to ensure your e-commerce business complies with all regulations.

- Technology and Software: Investment in essential software and technology solutions for inventory management, customer relationship management (CRM), and accounting.

- Logistics and Fulfillment: Costs for setting up logistics and fulfillment processes, including warehousing, packaging materials, and shipping services.

- Customer Service Setup: Initial setup costs for customer service tools and platforms, including live chat support, customer service software, and hiring staff for customer support roles.

=> Summarize the total initial investments and input in the calculator field.

=> After inputting these figures, press the “Calculate” button to create your ecommerce financial plan.

Step 7: Review Automatically Created Ecommerce Income Statement

The calculator generates essential financial statements, such as the income statement, detailing revenue, COGS, gross profit, operating expenses, and net profit. These statements paint a clear picture of your e-commerce business’s fiscal performance.

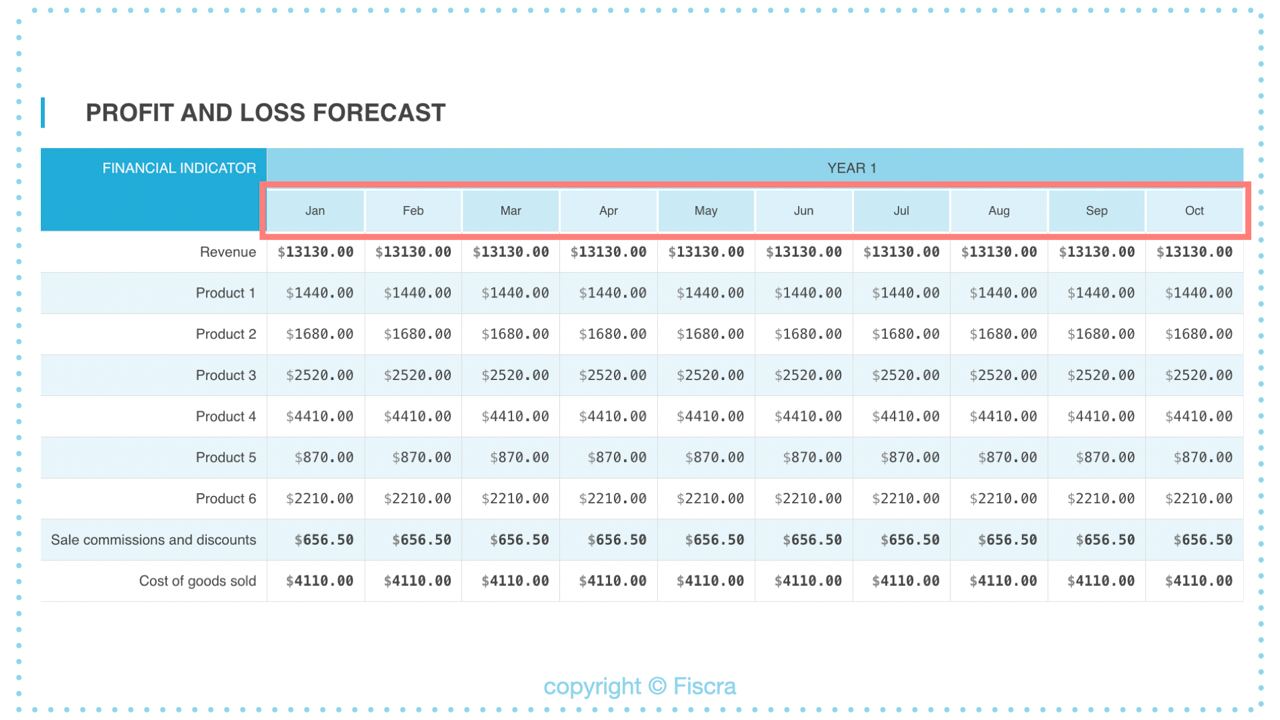

7.1 For the first year the financial forecast is created with a detailing of the financial data by months:

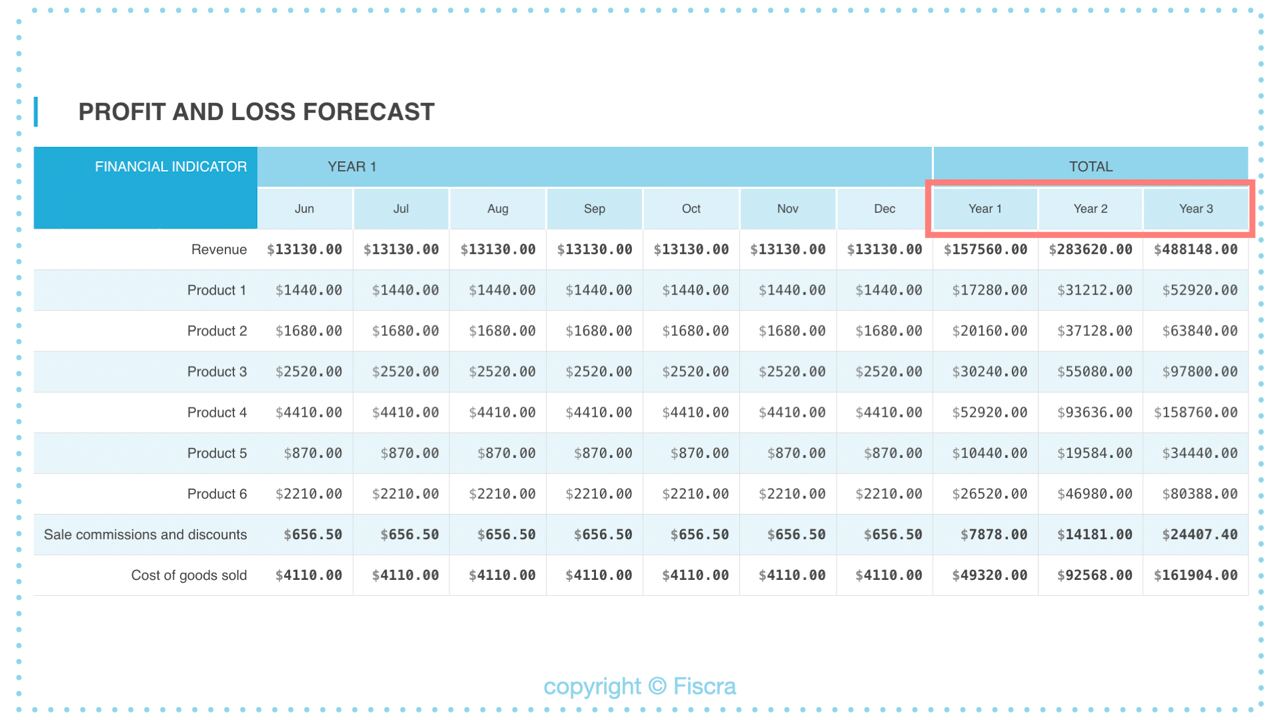

7.2 At the end of the ecommerce income statement ( profit and loss forecast) you can see the total financial data ( revenue, expenses, and profit) for each of the 3 forecasted years:

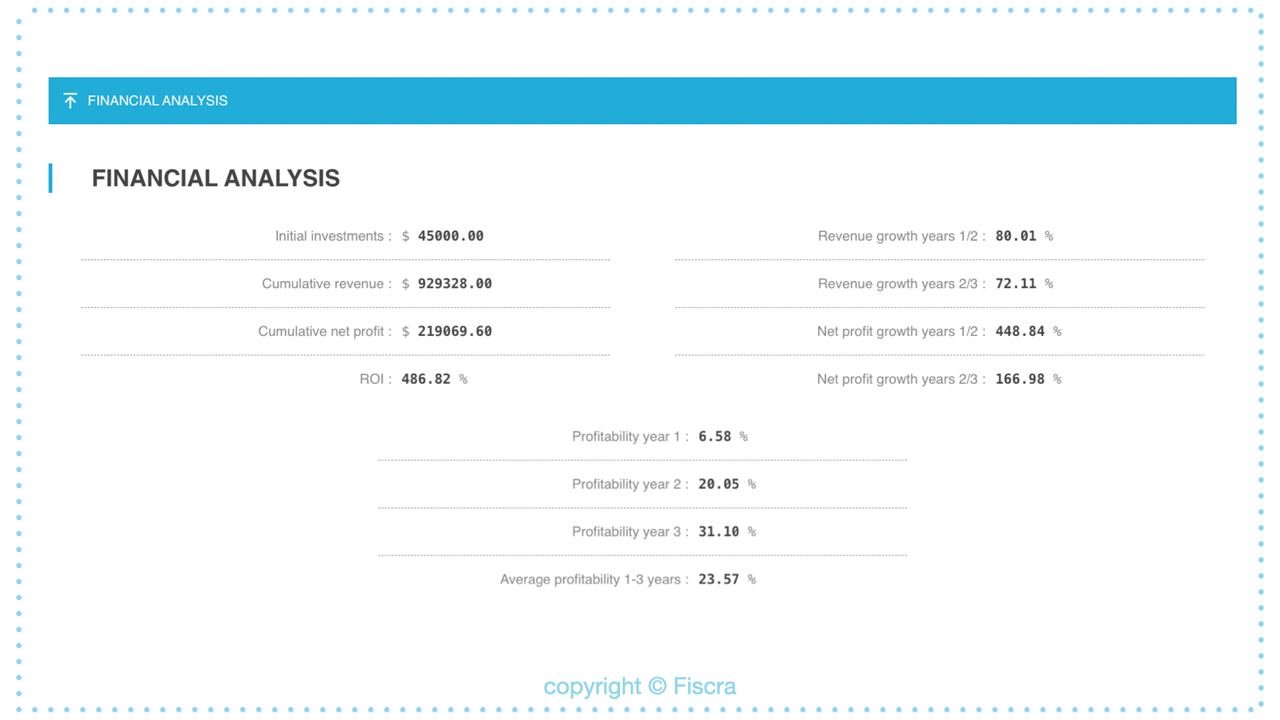

Step 8: Analyze the Financial Ratios of the Ecommerce Financial Model

The calculator automatically computes vital financial ratios, including revenue and profit growth, and return on investment (ROI), offering a quick snapshot of your e-commerce business’s financial health. This automated feature aids in immediate financial analysis, allowing for strategic adjustments and optimization.

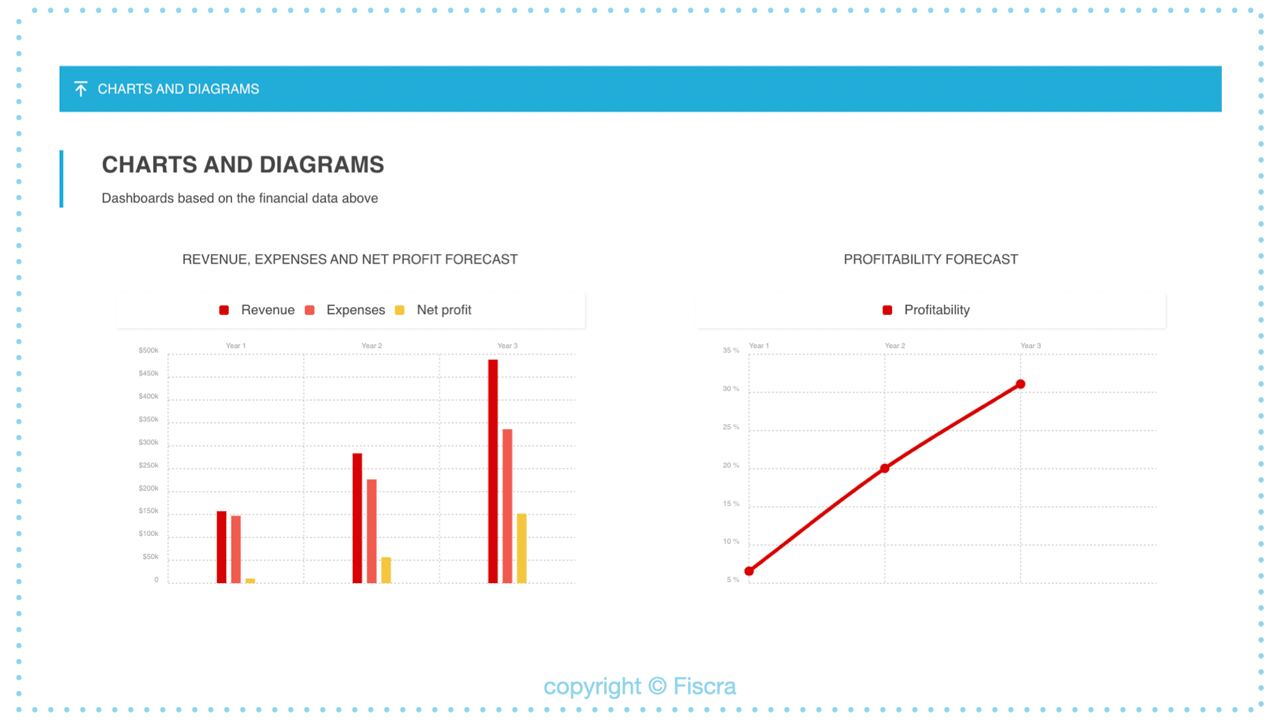

Step 9: Visual Insights through Graphs and Diagrams

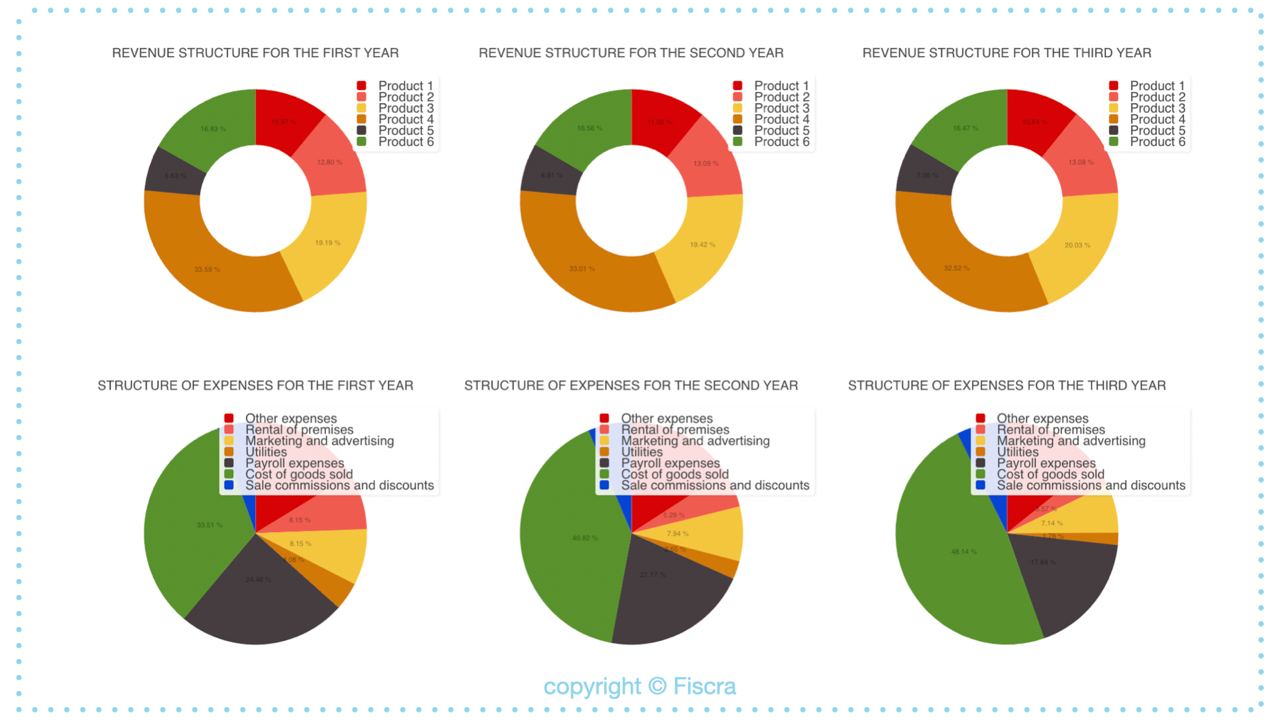

Examine the graphs and diagrams produced by the calculator to visually interpret complex financial data. This analysis provides insights into revenue patterns, expenditure trends, and profitability, enabling a deeper understanding of your business dynamics.

9.1 Analyze revenue growth, profit, and profitability for the 3 years of the ecommerce financial plan/model

9.2 Analyze the structure of revenue and expenses of the ecommerce financial model. It will help you to understand what types of goods provide you with the main part of your income. At the same time, you will understand that types of expenses are the most significant for your business.

Step 10: Review the Ecommerce Financial Plan

Review the calculated financial plan, including the automated ratios and visual data representations. This final assessment allows you to refine your strategies, ensuring they align with practical goals and market realities.

=> Click the back arrow to update the initial data:

Employing an e-commerce financial model calculator simplifies the financial management of an online store, from revenue projection to strategic financial planning. Regular use and review of this tool are vital for adapting to the ever-evolving e-commerce landscape, optimizing financial performance, and securing a path to sustainable growth and profitability.

Frequently Asked Questions for E-commerce Financial Model Calculator Page

What is an E-commerce Financial Model Calculator? It’s a specialized online tool designed to help e-commerce business owners create detailed financial projections, including revenue, expenses, and profitability analysis. The calculator simplifies financial planning by automating calculations for various financial metrics.

Who should use the E-commerce Financial Model Calculator? This calculator is ideal for e-commerce entrepreneurs, startup founders, and business managers looking to assess their financial performance, plan for growth, and make informed business decisions.

How does the calculator automate financial ratio analysis? The calculator automatically computes key financial ratios based on the data you input, including revenue and net profit growth, net profit margin (profitability), and ROI, providing insights into your business’s financial health.

What kind of financial statements can I generate with this calculator? The calculator produces comprehensive financial statements such as income statements, detailing revenue, cost of goods sold (COGS), gross profit, operating expenses, and net profit.

Can I use this calculator for forecasting future financial performance? Absolutely. By entering projected sales volumes, prices, and expenses, the calculator can help you forecast future revenue, profits, and financial ratios for strategic planning.

Is it possible to adjust my financial plan based on the calculator’s analysis? Yes, the calculator’s flexible design allows you to modify inputs and scenarios easily, helping you refine your financial projections and strategies as needed.

How do the graphs and diagrams provided by the calculator enhance financial analysis? The visual representations, such as graphs and diagrams, simplify complex financial data, making it easier to identify trends, analyze revenue and expense structures, and make data-driven decisions.

Where can I access the E-commerce Financial Model Calculator? The calculator is available online on this page, accessible through financial planning platforms, e-commerce resources, or specialized financial tools websites designed for business analysis.