Monthly Bookkeeping Services

Monthly bookkeeping is a natural operation that each healthy business requires. It is also time-consuming and resource-intensive, prone to mistakes, and requires additional verifications. When you trust monthly bookkeeping to professionals, you free your company’s resources for important decisions and strategic development. At Fiscra, we combine reliable processes with experienced bookkeepers and modern tools to deliver accuracy, consistency, and peace of mind, month after month.

What Are Monthly Bookkeeping Services?

Monthly bookkeeping services are a professional assistance in a company’s financial tracking throughout the year. Instead of the chaos of tax season or compiling a report at year’s end, your business records remain up-to-date and organized each month. Delegation of this service to professionals reduces the strain on your financial department and lets you focus on critical steps of business development.

Definition & Scope

Monthly bookkeeping services cover the full cycle of financial recordkeeping, including the following: daily transactions entry; expenses categorization; bank accounts reconciling; and monthly financial statements preparation.

Monthly bookkeeping services by Fiscra also include ledger maintenance, accounts monitoring, and ensuring that all the records are audit-ready. The result is clear, reliable data for smarter business decisions.

Why Consistent Monthly Bookkeeping Matters

Reliable bookkeeping isn’t just about accuracy – it’s about control and foresight. Monthly consistency ensures error-free reports, seamless audits, and full compliance readiness. It also uncovers valuable insights into spending patterns and cash flow, giving leaders the information they need to make strategic, data-driven choices that fuel long-term business growth.

Difference Between Monthly Bookkeeping vs Ad-hoc / Sporadic Bookkeeping

Unlike a monthly, consistent bookkeeping, an ad-hoc approach is prone to leaving gaps and discrepancies. When updates are recorded sporadically, the ledgers are filled with duplicate transactions and irrelevant insights. Monthly bookkeeping helps avoid these mistakes and enables real-time visibility of the business’s financial health and control that irregular bookkeeping can’t provide.

Our Monthly Bookkeeping Service Offerings

Are you ready to change your bookkeeping? We offer a complete suite of bookkeeping services to maintain your records accurately, up-to-date, and compliant. Fiscra delivers a complete suite of bookkeeping services designed to keep your financial records accurate, current, and compliant. Each month, we handle every aspect of your bookkeeping process, ensuring your business is always prepared for audits and reviews.

Why Choose Our Monthly Bookkeeping Services

Our Monthly Bookkeeping Process

Onboarding & Setup

Structured onboarding is the first step of every bookkeeping service by Fiscra. Our experts set up your chart of accounts, ask for access permissions, and review historical data of the company’s previous financial operations. We familiarize ourselves with your bookkeeping and categorization framework to create a seamless environment for bookkeeping tailored to your business operations.

Data Ingestion & Sync

Next, we securely connect your bank accounts, credit cards, and sales platforms to streamline transaction imports. Automated data syncing minimizes manual entry and ensures timely updates. Fiscra guarantees your bookkeeping remains current, accurate, and effortlessly maintained month after month.

Categorization & Matching

Even with secure automation, we thoroughly review and categorize each transaction. Our experts match them with the corresponding invoices, receipts, and payment records. This approach keeps your books audit-ready and makes navigation through the records much easier.

Reconciliation & Verification

In the next step, we reconcile all accounts by comparing recorded transactions against bank and credit account statements, promptly solving any discrepancies. This step ensures that your records accurately reflect the precise condition of your business, preventing issues during financial reviews.

Adjustment & Close-Out

Each month, closing comes with accruals, depreciation entries, and corrections to provide the most precise image of the company’s performance. This step prepares the books for reporting and gives a solid foundation for ongoing financial management and strategic planning.

Report Generation & Delivery

After reconciliation and close-out, we prepare comprehensive monthly financial statements, including an income statement, balance sheet, and cash flow summary. Each report is reviewed for accuracy and delivered with brief commentary. You receive clear, actionable insights into your company’s financial health.

Monthly Review & Feedback Loop

To keep improving our process, we schedule monthly review sessions to discuss reports, answer questions, and implement feedback. This continuous collaboration ensures your bookkeeping stays aligned with evolving goals and business needs, creating a responsive partnership that enhances accuracy, transparency, and long-term financial confidence.

Interesting Facts about Bookkeeping

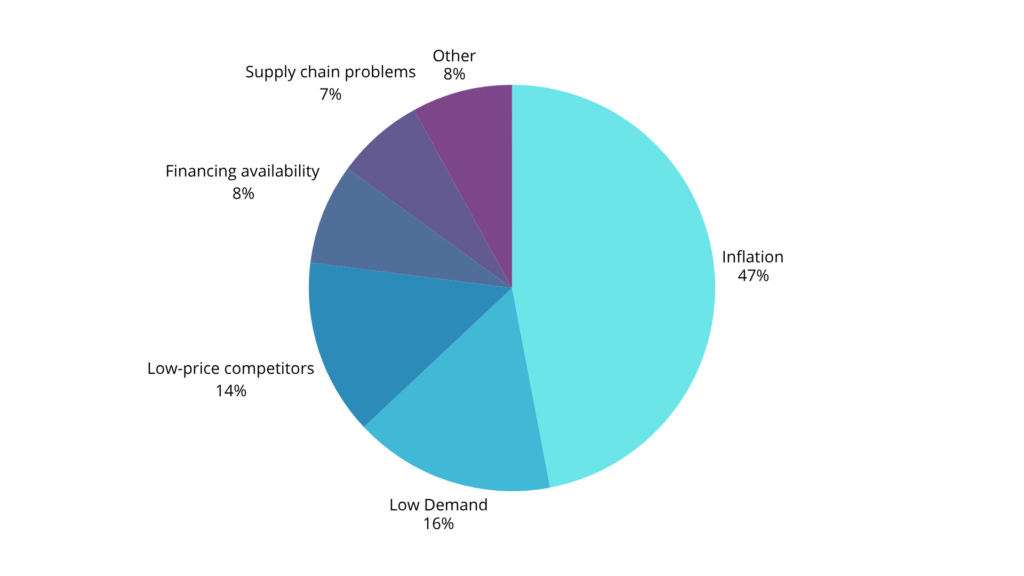

Accountants remain critical partners for businesses worldwide. In recent surveys, companies across Australia, the United Kingdom, and Canada emphasized how their bookkeepers and accountants played a key role in helping them navigate turbulent economic conditions. Nearly half of small businesses in these regions identified inflation as their top challenge, yet many credited their accounting professionals with reducing its impact through careful budgeting, cost management, and financial planning. As economic pressures persist, reliable bookkeeping and accounting support continue to be essential for maintaining stability and informed decision-making.

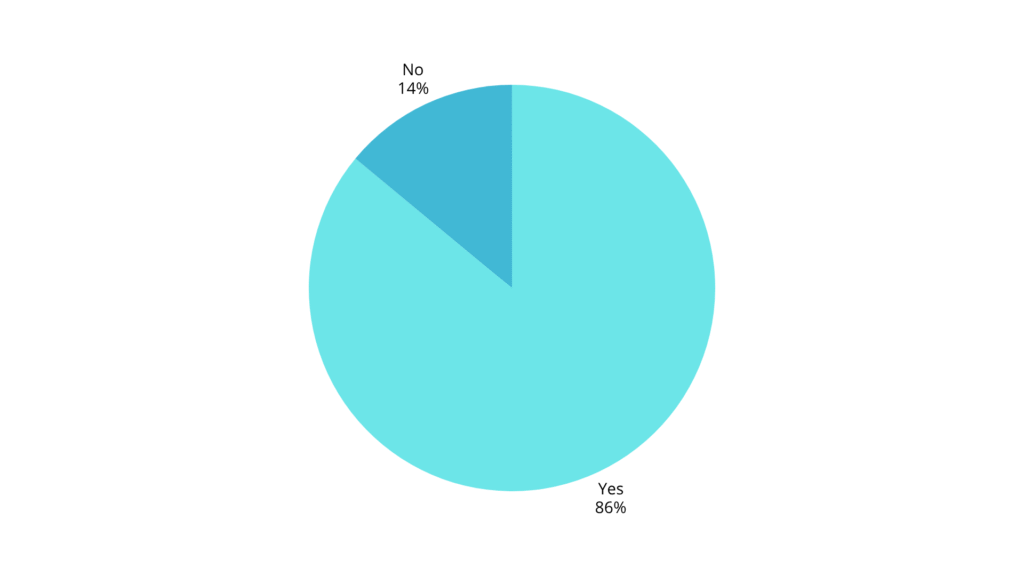

Has Your Accountant Helped You during the Last Year?

Yet, it is not the only benefit that bookkeepers provide. They help to evaluate financial patterns, make companies review-ready, and present them before the investor board or for the attraction of new customers. So, modern bookkeeping is more than ledger organization. It is a ticket to a successful strategy implementation.

Challenges for Small Businesses that Bookkeepers Help to Solve

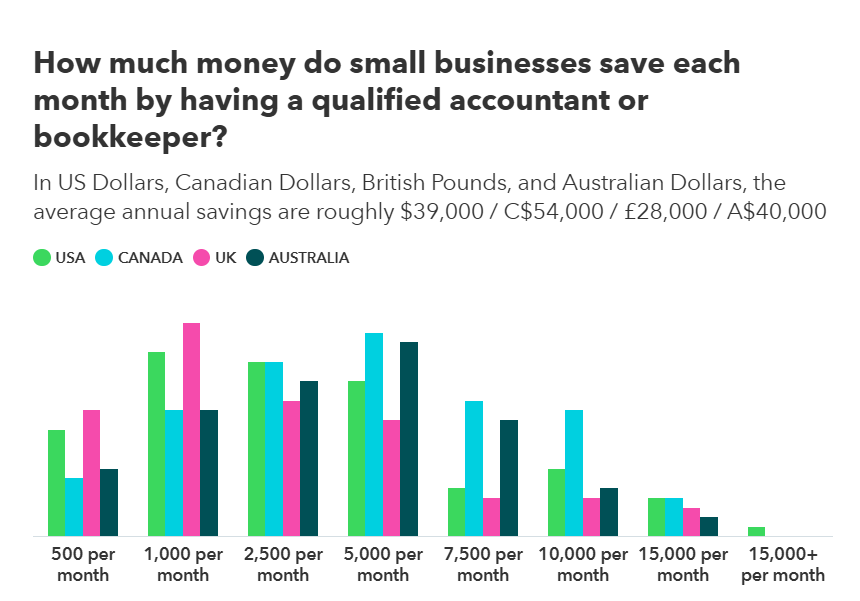

Bookkeeping is also more than grand moves. It is the day-to-day operations that keep small businesses afloat. And it is more than words – according to QuickBooks, US small businesses save approximately $39000 annually due to professional bookkeeping services. A similar tendency is present across the world.

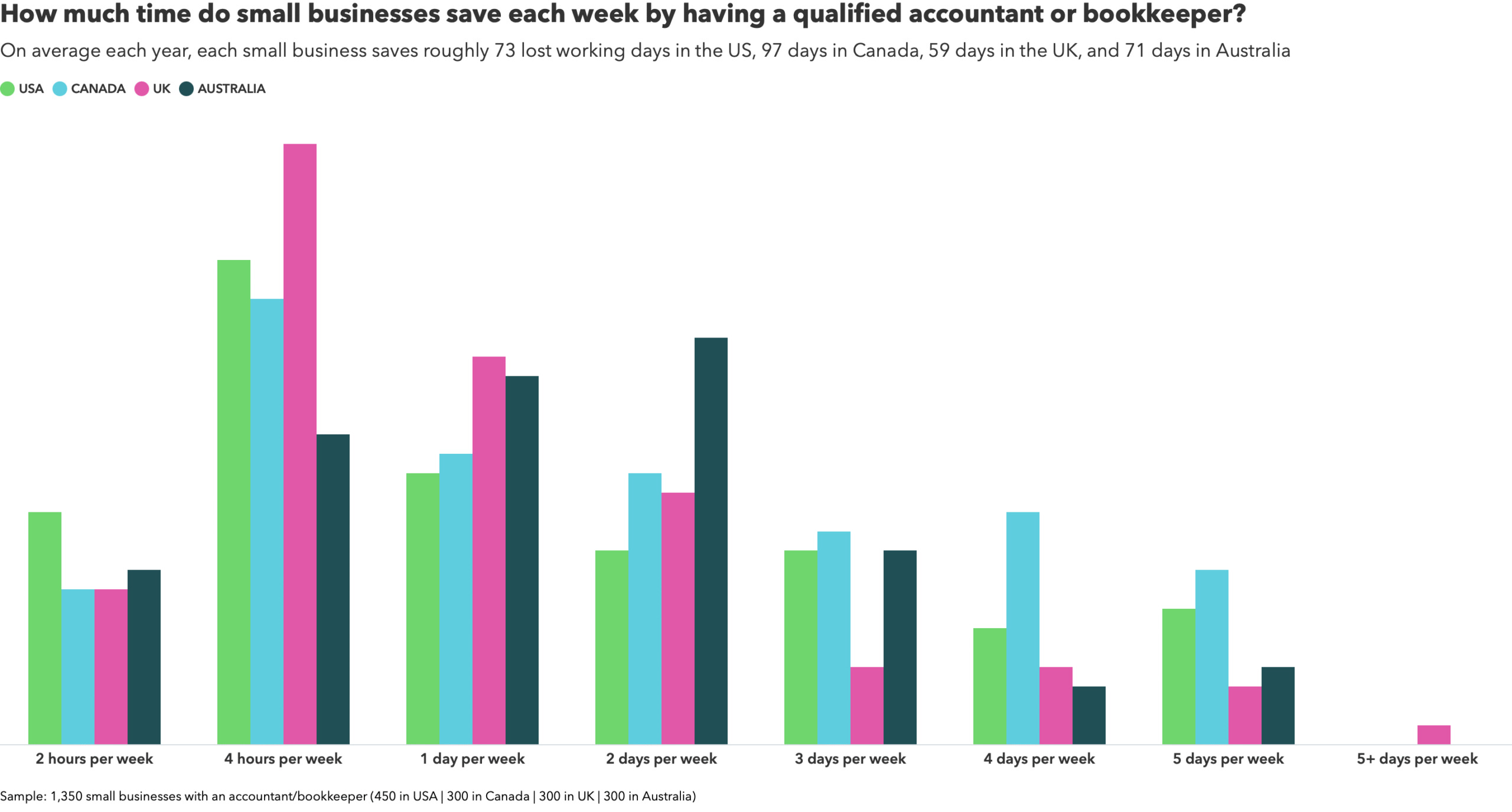

Money Saved with Professional Bookkeeping

The same is true for saved time. Canadian small businesses report that they save approximately 100 working days per year with efficient bookkeeping management.

Saved Time by Professional Bookkeeping