Cash Flow Management Services

Cash flow is a routine part of every business, easily overlooked. Yet, often, it becomes a source of unused potential. Here, at Fiscra, we help our clients maximize their company’s potential with professional cash flow management services. A combination of proactive strategies with clear insights helps our clients efficiently manage liquidity, reduce financial risks, and attain long-term financial stability.

What Is Cash Flow Management?

Cash flow is the movement of funds in and out of a business. Multiple sources of income and expenses form the cash flow stream. Management of these sources is a delicate balance between reserving, focusing, and directing the funds to maintain the financial health of a business.

Cash Flow Management Definition

Cash flow management practices refer to overseeing and redirecting incoming revenues and outgoing payments to maintain sufficient liquidity. Cash flow management includes accounts receivable balancing, accounts payable, and operational costs during the planning process of the company’s cash needs. Cash flow management’s aim is to ensure business solvency and adaptability.

Why It Matters for Businesses (liquidity, sustainability, growth)

Businesses of any scale should pay attention to their cash flow to remain liquid. High liquidity grants flexibility in meeting the obligations, immediate and long-term, invest in opportunities, and pay suppliers.

Efficient cash flow management also prevents shortfalls and guarantees resource availability for daily operations. Finally, consistent and predictable cash flow builds a foundation for planned expansion and profitable growth.

Importance of Cash Flow Management Services

Cash flow management takes time, effort, and additional resources that could have been directed toward strategic decision-making and planning for future business projects. Professional cash flow management services can help relieve some of that strain. Your business will gain the necessary tools and frameworks to maintain financial health, ensure long-term stability, and minimize potential risks.

Financial Stability & Liquidity

Business Growth & Expansion Planning

Risk Reduction & Crisis Prevention

Risk Reduction & Crisis Prevention

Better Investor & Stakeholder Confidence

Our Cash Flow Management Service Offering

We believe that each business requires unique cash flow management solutions. Therefore, we offer a wide range of services that may fit exactly for you: forecasting, optimization, daily operations, financial frameworks – anything to increase financial visibility and performance. Our services are a tool for your empowerment and sustainable growth.

Who Benefits from Our Services?

Our cash flow management services are tailored for companies at every stage of development. Whether you’re a startup seeking stability or a corporation preparing for its next significant step, Fiscra delivers clear, practical solutions to support your goals. Each client receives a personalized approach that ensures financial stability and efficient resource allocation across all operations.

Startups & Small Businesses (need consistent liquidity)

Startups and small businesses will benefit from professional cash flow management services to maintain financial stability and plan the most risky growth steps. We can help avoid cash shortages, predict future challenges, and advise on expense management. With our tools and support, your startup will build the necessary credibility, allowing you to focus on strategic development.

Growing Enterprises (scaling & expansion support)

Financial challenges become more complex as the business expands. We can assist your company in forecasting capital needs, optimizing everyday working capital, and developing a roadmap for sustainable scaling. We ensure that expansion plans are financially viable, helping companies manage growth strategically without jeopardizing operational liquidity or long-term financial health.

Established Corporations (complex multi-stream cash flows)

It is a common challenge for established corporations to manage multiple revenue streams mixed with international operations and subsidiaries. Our specialists can simplify this management task by delivering structured oversight, actionable insights, and advanced analytics. With our professional services, your company will maintain liquidity across divisions, unlock trapped funds, and ensure efficient capital distribution throughout its enterprise network.

Investors & Financial Controllers

Are you an investor or a financial controller who wants to verify your potential investment? Our cash flow management services will provide you with insights into liquidity trends and financial opportunities. Our reporting tools enhance oversight, support risk assessment, and empower stakeholders to make informed choices that align with performance goals and investment strategies.

Our Methodology: How We Manage Cash Flow

At Fiscra, we combined cutting-edge technologies with field expertise and years of experience. Our process includes analysis, forecasting, and improvement of the current business cash flow. We assist you in achieving balance and finding the right spot between efficient balance management and evolving growth. Learn in detail what steps we take to help our clients.

Benefits of Working with Us

Improved Liquidity & Predictability

Data-Driven Financial Insights

Tailored Strategies for Your Industry

Transparent Reporting & Continuous Support

Tools & Techniques We Use

Advanced Financial Planning Tools

Fiscra employs advanced financial planning tools to deliver precise forecasts and actionable insights. Our technology enables real-time monitoring of cash movements, automated reporting, and scenario simulations. These tools help businesses identify trends early, streamline financial processes, and maintain optimal liquidity levels through accurate, data-backed decision-making and proactive management.

Industry Benchmarking & Data Analysis

We combine industry benchmarking with in-depth data analysis to measure performance against market standards. This analytical approach ensures your cash flow strategies remain competitive, efficient, and aligned with evolving business conditions.

Interesting Facts about Cash Flow Management

Small businesses operate in an increasingly competitive environment. They not only need to stand out in the market but also maintain healthy financial stability to avoid unnecessary borrowing.

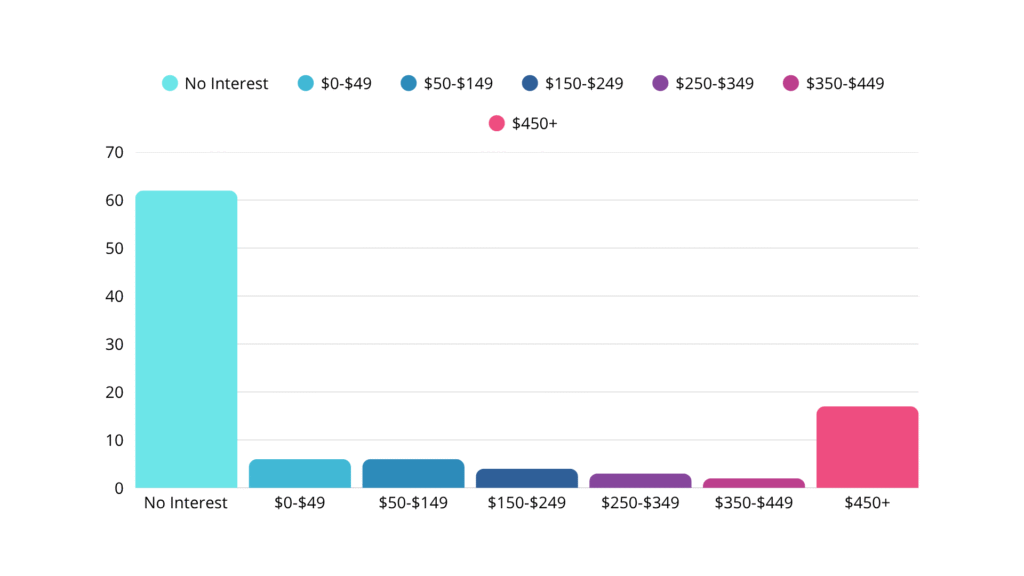

According to QuickBooks, 70% of small businesses became borrowers in 2023. Professional cash-flow management helps reduce this dependency and allows owners to focus on strategic growth rather than reacting to financial emergencies. In 2023, a significant percentage of companies also paid interest on business credit cards, highlighting how quickly financial obligations accumulate without proactive oversight.

The percentage of companies that paid interest on business credit cards

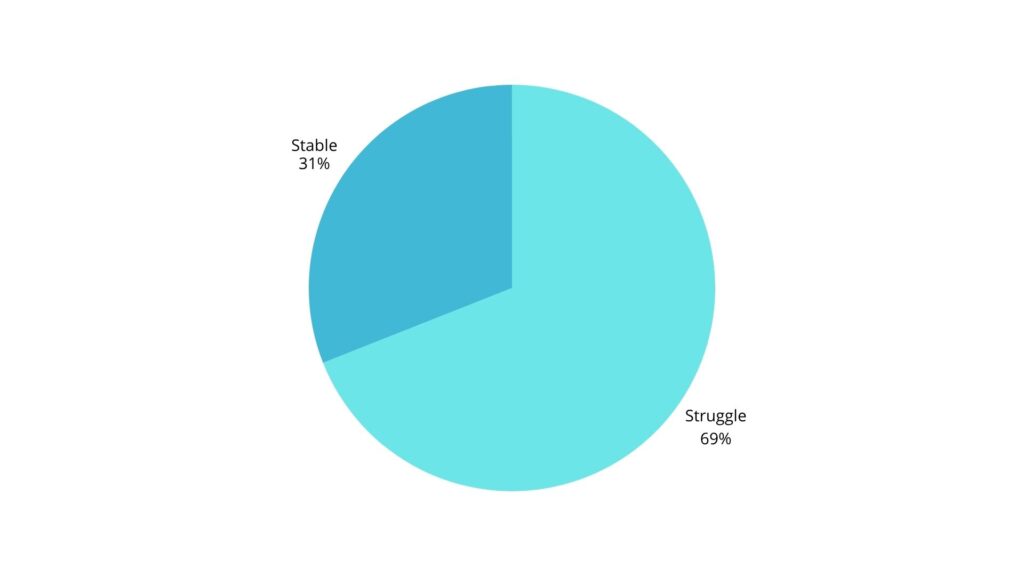

Cash flow isn’t just about budgeting – it directly impacts operational continuity. Decreasing profit margins, insufficient cash reserves, and unpredictable growth often lead to financial instability. With dedicated cash-flow services, businesses can forecast demand, prevent shortages or overproduction, and maintain a stable financial rhythm.

Cash Flow Issues Are the Leading Financial Obstacle for Small Businesses, according to QuickBooks

Ready to Take Control of Your Cash Flow?

Schedule a Free Consultation

Take the first step toward mastering your company’s finances with a free consultation from Fiscra. Our experts will assess your current cash flow situation, identify challenges, and outline practical improvements. This initial session provides valuable insight into how professional cash flow management can enhance stability, efficiency, and long-term growth.

Request Your Customized Cash Flow Management Proposal

Request a personalized proposal from Fiscra to discover how our tailored solutions can support your goals. We’ll design a strategy aligned with your industry, size, and objectives – offering clear steps to strengthen liquidity, streamline cash flow, and achieve greater financial control and predictability.