Definition of the startup financial model

A startup financial model is a tool to forecast the financial performance of startup companies.

It helps to understand how to improve main financial indicators, like revenue or profit. It also can be used as a plan to achieve financial goals.

The model is based on historical data (if available) and assumptions about the future.

The purpose of the financial model for startups

The purpose of the financial model is:

- to have a financial plan;

- to understand the financial prospects of the company;

- to predict the company’s cash flow, profitability, and other financial metrics;

- to assess the financial impact of different business decisions;

- to attract investments.

I like to create financial models with the business owners or the company’s manager. After finishing the preparation of the financial model the business owners or the company’s manager have a lot of ideas about what can be improved to achieve the higher profit. We can do it in a few hours: to see how suggested ideas influence profit growth.

The Important step here is to understand what types of activities and products give the most of the income and the profit. At the same time, what types of activities and products just waste your time and create a small part of the total income and the profit.

So, it is an amazing process for me to analyze different financial models. It is one of the main goals of the financial model creation.

Let’s describe step by step how to create financial models.

The simple financial model for startups includes:

- Initial data ( Assumptions of the project).

- Financial calculations of revenue, expenses, and profit. All this information can be seen in the Profit and Loss forecast (P&L).

- Investment calculation.

- Financial analysis: calculation of financial KPIs. They can help to understand business owners and investors the risks and potential rewards of investing in a startup.

A financial model for startups can be prepared in Excel or Google Sheets. In my experience, other special software is rarely used for this.

Let’s consider each element of the financial model in detail.

1. Initial data of the startup financial model

The key inputs are all necessary numbers to create a financial model for startups. This is the initial information that will be used to create a profit and loss forecast.

The key inputs of the financial model include:

1.1 For revenue calculation:

– list of goods or services for sale (hereinafter – ‘Products’);

– prices of your products;

– the volume of sales forecast for each product;

1.2 For expenses calculation: list and amounts of monthly expenses;

1.3 Investment calculation necessary for the launch or development of the project. It can be equipment, furniture, computer hardware, vehicles, tools;

1.4 Other important data for the project.

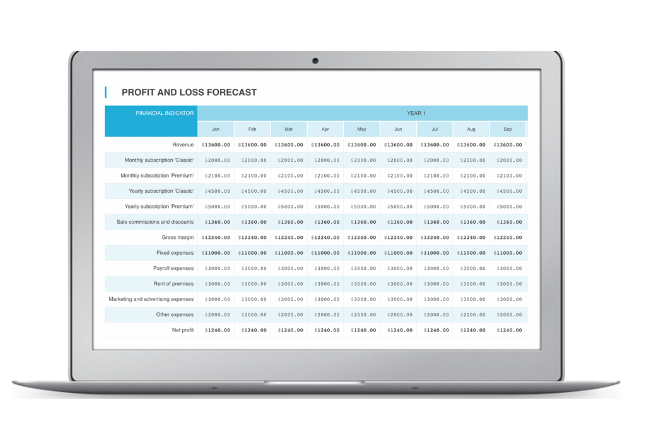

2. Profit and loss forecast as a main part of the financial model for startups

Profit&Loss forecast is a main part of the financial model for startups. It shows a forecast of the main financial data:

- revenue;

- cost of goods sold;

- monthly expenses;

- profit or losses.

The profit and loss forecast is usually created for 3 years. But it can be prepared for a longer period ( 5 or 10 years), based on a request of owners or investors.

A detailed explanation of how to create a profit and loss forecast can be found in this article: Learn to Make Profit and Loss Forecast with Free Template.

3. Investment calculation for the financial model for startups

Initial investment is the amount of money necessary to start or develop a project.

Usually, the initial investment includes equipment, furniture, computer hardware, vehicles, and tools which should be bought at the beginning of the project.

In addition to this amount, it is necessary to add the amount of losses, that should be covered by a business owner till the project profitability.

But if you have an IT project that doesn’t need a lot of equipment or tools, initial investment equals only total losses before the project becomes profitable. In this case, to see the total amount of the initial investment, the profit and loss forecast is necessary.

4. Financial KPIs for the financial model for startups

Financial KPIs help to understand the financial performance of the project and can help to compare different projects.

The basic financial KPIs are:

- ROI;

- Revenue and profit growth;

- Payback period;

- Profitability;

- Break-even point.

The detailed calculation of the Financial KPIs is described in the article: Financial Analysis for Startups.

Steps of creation startup financial model

Creating a financial model for a startup is a nuanced and complex process that demands a deep dive into both the internal operations of the business and the external market forces at play. This detailed guide will walk you through each step of creating a financial model, offering a structured approach that includes specific actions or sub-steps to take. Integrating online tools and resources can significantly aid this process, enhancing both the accuracy and efficacy of your financial model.

1. Gather Historical Data

The process begins with the collection and analysis of your business’s past financial performance. This step is crucial for establishing a factual basis for your model. This step involves a meticulous collection and analysis of past financial performance, including sales volumes, cost of goods sold, pricing models, main monthly expenses, sales growth rates, and any other financial metrics relevant to your business.

Detailed actions:

- Collect Financial Statements: Start by gathering all relevant financial documents, including income statements, balance sheets, and cash flow statements from previous years.

- Analyze Financial Metrics: Look into key financial metrics such as revenue growth rate, gross margin, operating expenses, and net profit margin. Understanding these trends is critical for forecasting.

2. Analyze the Market

Understanding the market and competitive landscape is essential for accurate financial modeling. This involves assessing the growth potential of your target market, analyzing competitors’ pricing strategies and product offerings. It will be an additional base for creating assumptions for your project. Analysis of competitors will help to create the list of the main and most popular products and services and their average prices on the market for your project. Later you can adjust prices in your project’s financial model, understanding the quality of your products/ services and their unique characteristics.

Analysis of the growth potential of your target market will help you to create assumptions about the sales volume growth rate for your project.

Detailed actions:

- Market Size and Growth: Estimate the total market size and its growth potential. This helps in understanding the scalability of your business.

- Competitor Analysis: Identify direct and indirect competitors, analyzing their pricing, market share, and product offerings.

3. Make Assumptions

Based on the insights gained from historical data and market analysis, the next step is to formulate informed assumptions about your business’s future. This involves projecting future sales, costs, and the impact of external factors. These assumptions are critical for building a realistic and adaptable financial model.

Detailed actions:

- Revenue Projections: Make assumptions about future sales volume and pricing strategies based on market trends and historical growth rates.

- Cost Projections: Estimate future costs, considering both fixed and variable costs, and how they might scale with the business.

- External Factors: Consider the impact of external factors such as economic conditions, regulatory changes, and technological advancements on your financial model.

4. Creation Elements of the Financial Model

Developing the financial model can be approached in two ways: using a pre-existing template or building one from scratch. Both require an in-depth understanding of your startup’s financial aspects and strategic goals.

Detailed actions:

- Template vs. Custom Model: Decide whether to use a pre-existing financial model template suited to your business type or to build a custom model from scratch.

- Model Components: Include key components such as revenue projections, cost estimates, cash flow statement, balance sheet, and income statement.

- Interconnectivity: Ensure all parts of the model are interconnected, allowing for changes in assumptions to automatically update projections across the model.

5. Analysis and understanding of the financial model

An analysis of the financial model is an important step. You can understand here if your expectations of the business income, profit, and profitability are realistic; and if your business can earn the money you expect.

To understand it, answer the following questions:

- How much money do you want to earn from your business per month/quarter/year? If this amount approximately equals the net profit for the corresponding period, you are on the right way.

- How many products your company can sell per month/quarter/year? What selling volume is realistic? Check how it corresponds with the selling volume in the financial model.

- What are the selling prices of your products/services? Are they in the range of competitors’ prices? Compare your real selling prices and the prices in the financial model. They should be the same or similar if you don’t plan to update the prices of your products/ services.

- Can you increase prices to improve the business profitability? Compare prices of your products/ services and competitors’ prices. If it is necessary, update prices in the financial model.

- Can you decrease monthly expenses to improve the business’s profitability? Check line-by-line monthly expenses in the financial model and think if they can be decreased. If it is necessary to update then the financial model for startups.

6. Review and Revise

The financial model is not a one-time effort but a living document that requires regular updates and revisions. This step involves comparing the model’s projections with actual business outcomes, revising assumptions, and adjusting the model accordingly. Regular review ensures the model remains an accurate and effective tool for financial planning and decision-making.

Detailed Description:

- Performance Review: Regularly compare the model’s projections with actual financial performance to identify variances.

- Assumption Revisions: Update assumptions based on new information, market feedback, and operational changes.

- Model Adjustments: Make necessary adjustments to the model to maintain its accuracy and relevance over time.

Example of the simple startup financial model

Here is an example of a simple financial model.

- Initial data (assumptions)

Price per unit = $ 100

Quantity of sales: Year 1: 500 units, Year 2: 700 units, Year 3: 900 units

Cost of sales, per unit sold (variable costs): Year 1: $30,0, Year 2: $28,6, Year 3: $27,8

Fixed costs: Year 1: $25 000, Year 2: $35000, Year 3: $45000 - Profit and loss forecast (P&L)

| Financial indicator | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | 50 000 | 70 000 | 90 000 |

| Cost of sales / Cost of goods sold | 15 000 | 20 000 | 25000 |

| Gross Profit | 35 000 | 55 000 | 65 000 |

| Fixed costs | 25 000 | 35 000 | 45 000 |

| Net Profit | 10 000 | 20 000 | 20 000 |

- Investment calculation

The total amount of investment for this project consists of furniture, tools, and equipment and equals $50000. - Financial analysis

- Revenue growth: Year 1-2: 40%; Year 2-3: 29%

- Payback period: 3 years

- Profitability ( Net Profit to Revenue): Year 1: 20%, Year 2: 29%, Year 3: 22%

- ROI = 100%.

More examples of online financial models for startups =>

Creating a Financial Model for Startups with Fiscra’s Online Calculators

At Fiscra, we recognize the significance of simplifying financial modeling for startups. Our user-friendly online calculators are crafted to assist entrepreneurs in building robust financial models effortlessly, even without a financial background. Here’s a streamlined guide on how to create a financial model using Fiscra’s online calculators:

Step 1: Choose a Calculator for Your Business

You need to choose a calculator tailored to the specific business you want to start => Click here. If the desired business is not available, the universal calculator can be used as an alternative.

Step 2: Input Essential Information

Follow the prompts provided by the calculator to input key information about your startup. This includes prices of products or services, volume of sales, monthly expenses, and other relevant details. Fiscra’s intuitive interface ensures a smooth data input process.

After that just click CALCULATE.

As you can see, the financial model can be created online only with the help of your laptop or mobile phone.

Step 3: Review the Generated Model

Once you’ve inputted all the necessary data, let Fiscra’s calculator work its magic. Review the comprehensive financial model, which includes:

- Profit and Loss Forecast;

- Financial Analysis;

- Charts and Diagrams.

Gain insights into revenue projections, expense breakdowns, and profit dynamics.

Key financial ratios, Charts and Diagrams will help you to visualize data:

- Financial Analysis: Explore the financial analysis provided, gaining insights into your business’s performance.

- Charts and Diagrams: Examine the visually appealing charts and diagrams that showcase key financial metrics.

Step 4: Refine and Iterate

Evaluate the initial model and make any necessary adjustments. Fiscra’s online calculators are designed to be user-friendly, enabling you to refine your financial model iteratively. Experiment with different assumptions to see how they impact the overall projections.

Step 5: Leverage Fiscra’s Support Resources

If you encounter any challenges or have questions about utilizing Fiscra’s online calculators effectively, take advantage of the available support resources. Write to our email: info@fiscra.com

Step 6: Stay Informed and Adaptive

As your startup evolves, stay informed about industry trends and adjust your financial model accordingly. Fiscra’s calculators can be valuable assets in adapting your projections to reflect the dynamic nature of the business environment.

Empower your startup’s financial planning with Fiscra’s online calculators, making the process of creating and updating a financial model a seamless and insightful experience in just a matter of minutes, regardless of your financial background.

Conclusions: how to create a financial model for startups

- A simple financial model for a startup usually consists of initial data (assumptions), financial statements ( profit and loss forecast, investments calculation), and financial analysis ( calculation of profitability, payback period, ROI, etc.).

- The initial data ( assumptions) should be prepared carefully based on historical data, available resources analysis, and competitors’ prices and products. In this case, the financial model will be more realistic. It is the basis of the financial model.

- The financial model can be created in Excel, Google Sheets, or using different special software. The most common is using Excel and Google Sheets;

- The period of data forecast is usually 3-5 years. Detailing can be done on a monthly basis for the first years, and for the rest – on a year basis.

Frequently asked questions for startup financial model

What is a financial model?

A financial model is a tool, typically built in Excel or similar software, that forecasts the financial performance of a business over a specific period. It uses historical data, assumptions about the future, and calculations to project future income, expenses, and cash flow.

Why is a financial model important for startups?

For startups, a financial model is essential for several reasons:

- Planning and Strategy: It helps entrepreneurs test different business scenarios and strategies to understand potential financial outcomes.

- Fundraising: It is a critical tool for raising capital, as investors want to see detailed forecasts of revenue, profits, and cash flow.

- Financial Management: It assists in budgeting, managing cash flow, and monitoring the financial health of the business.

What are the key components of a financial model for startups?

A comprehensive financial model for startups typically includes:

- Cash Flow Statement: Analysis of how cash enters and leaves the business.

- Income Statement: Also known as a Profit and Loss statement, it shows the company’s revenues and expenses.

- Balance Sheet: A snapshot of the company’s financial position at a specific point in time.

How do I start creating a financial model for my startup?

To create a financial model:

- Gather Historical Data: If available, collect historical financial data about your business and analyze it: prices, cost of sales, main monthly expenses, sales volume, sales growth, and others.

- Analyze the Market: competitors’ prices and list of main products or services.

- Make Assumptions: Make informed assumptions about future growth rates, costs, and other financial metrics.

- Creation elements of the financial model:

- Start with a Template: Use a financial model template suited to your business type as a starting point. Try our calculators for this purpose.

- Or Create a financial model from scratch: Develop each component of the model step by step, ensuring that all parts are interconnected.

- Analysis and understanding of the financial model. You can understand here if your expectations of the business income, profit, and profitability are realistic; and if your business can earn the money you expect.

- Review and Revise: Regularly review the model for accuracy and revise assumptions as necessary.

Can I create a financial model with no financial background?

Yes, but it may require more effort to learn the basics of financial modeling and accounting principles. Many online resources and courses can help beginners understand how to create effective financial models. Additionally, using our free financial models – calculators will significantly simplify the process.

How often should I update my financial model?

Your financial model should be a living document, updated regularly as you gain more insight into your business operations, market conditions, and financial performance. A monthly review is typical, but some aspects might require more frequent updates, especially in the early stages of the startup.

Are there any tools or software recommended for creating a financial model?

Excel is the most widely used tool for financial modeling, thanks to its flexibility and advanced features. However, there are also specialized software options and platforms designed for financial modeling that might offer templates, tutorials, and support for startups. Try our free financial models online for this purpose.

Creating a financial model is a complex but essential task for startups. It provides a roadmap for the business, helps attract investors, and guides financial decision-making. With the right approach and tools, even those new to finance can develop a robust financial model.

About the author

Kateryna Moskovenko

Financial Consultant with 12 years’ experience in accounting, management accounting and financial modeling; Founder of Fiscra; Author of courses and trainings in financial modeling, business planning, and entrepreneurship; prepared more than 50 financial models for startups.

Linkedin