Crowdfunding vs Venture Capital: Which Model Works Better in 2025?

The second half of 2025 marks an inflection point. VC capital across the globe has dipped slightly in comparison to Q1 2025 to Q2 2025, from $ 126.3 billion to $101 billion, according to the Venture Pulse report. Yet, VC investments remain persistent, showing that investors are seeking new, safer ways to utilize their capital before making a move on any deals.

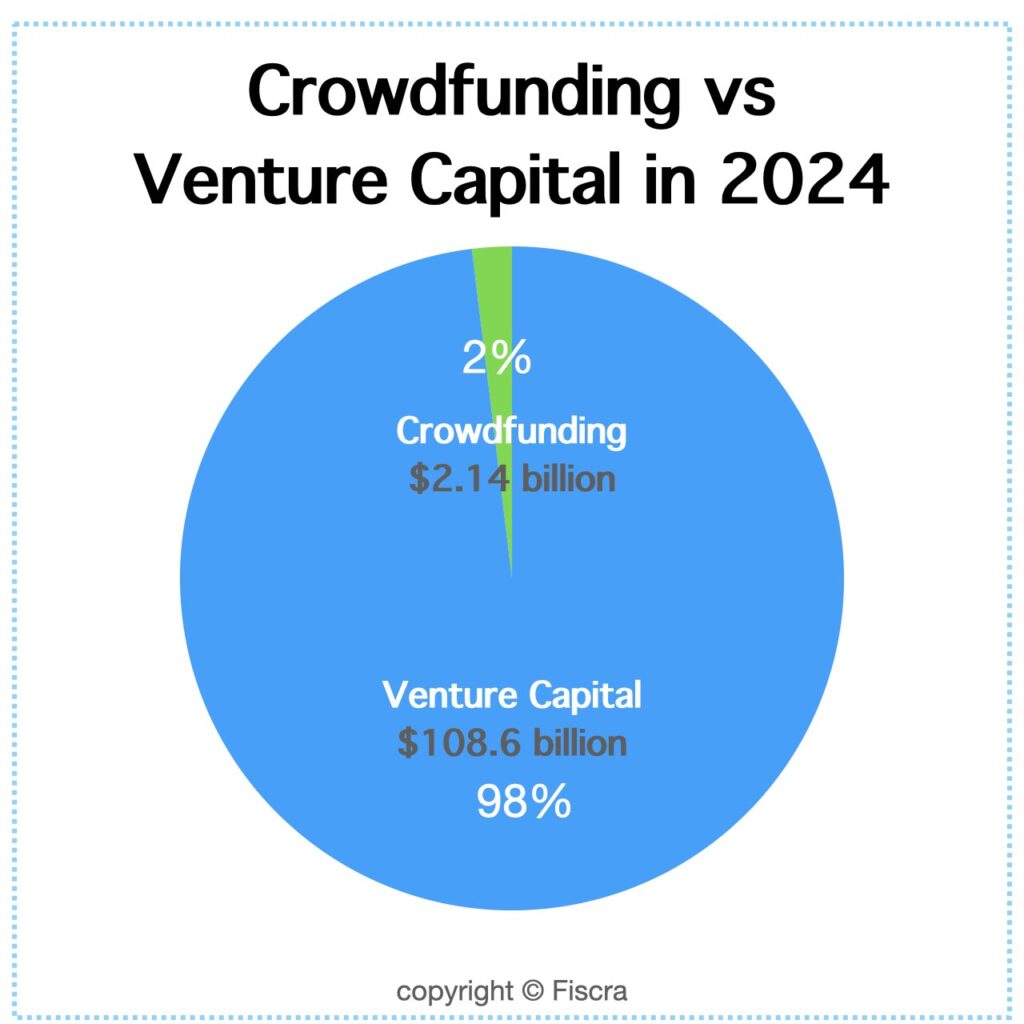

At the same time, crowdfunding continues to show consistent growth. Its market size was USD 2.14 billion in 2024. It is expected to reach USD 5.53 billion by 2030, with a 17.6% CAGR from 2025 to 2030, according to the Crowdfunding Industry report. While VC is restricted due to global economic headwinds, equity and token-based crowdfunding platforms become more accessible to a broader public, allowing retail investors to take fractional stakes.

AI innovations impact both fields, influencing VC preferences and facilitating liquid crowdfunding structures. Which leads to the most critical question: which model is more preferable for business founders and investors in 2025?

Crowdfunding Business Model Overview

Crowdfunding is a model of amassing capital for a project via a large group of people. While different models with similar principles coexist, the term “crowdfunding” refers to internet platforms that collect funds without the use of standard financial intermediaries.

Modern crowdfunding offers several models. They differ in the approach, potential benefit, and included risks. The models are:

Reward-based crowdfunding

This type of crowdfunding offers pledgers access to the product, perks, communication with the development team, and other bonuses. Reward-based crowdfunding examples are Kickstarter, Indiegogo, and similar platforms. The success rate of such campaigns ranges from 30% to 40%.

Equity crowdfunding meaning

Crowdinvesting is another term for equity crowdfunding. In this model, investors provide funding to startups or growing businesses in exchange for equity shares. Unlike donation- or reward-based crowdfunding, crowdinvesting is considered a form of securities offering, which means it is subject to strict regulations (for example, the U.S. Securities and Exchange Commission (SEC) and the European Crowdfunding Service Providers Regulation (ECSP) in the EU).

Due to these regulations, crowdinvesting platforms provide a higher level of investor protection compared to other crowdfunding models, although they also incur higher compliance costs for companies raising funds. Some of the most popular platforms include Crowdcube, Republic, and Wefunder.

Debt-based crowdfunding definition

It is a similar procedure to equity crowdfunding, which allows companies to develop business ideas without losing ownership over them. A startup obtains a loan from a group of investors through specialized platforms to fulfill its business plan and repay the debt at an average yield of 10%. The most popular debt-based crowdfunding examples are Prosper, Funding Circle, LendingClub, and Upstart.

Crowdfunding Campaign Stages

The crowdfunding campaign starts with a pitch on the platform of choice. Then, a startup goes into a marketing campaign promoting the pitch through social media. A release clause is a vital part of such a campaign – it is either all-or-nothing or keep-what-you raise, promising investors tangible results when the campaign ends.

If the campaign is successful, the founder gets the funds, equity investors receive their share of tokens, and the debt platform’s public repayment schedule is established.

Crowdfunding Market Size

The crowdfunding market is still very small compared to the VC turnaround: $108.6 billion vs $2.14 billion. Yet, it shows consistent growth, and equity crowdfunding stands out as the most promising branch, as the fastest-growing crowdfunding field with additional legal frameworks across the globe.

Reward-based crowdfunding does not diminish either, helping to implement art projects or strengthen brands’ presence in the market.

Pros & Cons

| Advantages | Disadvantages |

| Access to a wider capital beyond accredited investors | Used for early-stage startups, poorly fit for scaling up. |

| Easier marketing and community-building via a crowdfunding campaign. | Smaller check size compared to other funding methods. |

| Transparency and no dilution concentration | High investor expectations and regulatory complexity, especially in debt-based crowdfunding campaigns. |

Venture Capital Model Overview

Venture capital, or VC, refers to the pools of institutional capital managed by professionals. Limited partners (LPs) are the main source of funds for VC. Endowments, pension funds, and family offices are examples of LPs. The funds are deployed in regulated stages. The VC ticket size varies from $100k to $100 million, depending on the stage.

Q2 2025 showed a decline in volume from $128 billion in Q1 2025 to $101 billion in Q2 2025. Yet, the number of deals as well as interest in VC funding remains consistent. Investors from both the Americas (primarily the US) account for 70% of the deals, Europe represents a 15% market share, and Asia covers the remaining 15%.

The VC funding key features include the following:

- Funding volume. 2025 keeps the trend of mega-deals in the AI and defense tech deals. For example, the ScaleAI deal of $14.3 billion impacted the overall deal numbers.

- Strict structure and governance. Leading VC investors have a board of representatives. They also have inner regulations that regulate investing strategy, exit mechanisms, and ensure consistent growth and high ROI.

- Sector emphasis. VC investments stick to specific fields. In 2025, these are AI, defence tech, and fintech. The main criterion for choosing a specific VC investment field is being capital-efficient and high-impact.

Pros & Cons

| Advantages | Disadvantages |

| Wide networking, mentoring, and growth opportunities | Strong dilution, disputable ownership. |

| Big check sizes, perfect for mid and late stage projects, and scaling up. | Slow decision-making and approval processes |

| Structure and diligence. | Strict regulations and high expectations |

| High potential returns |

Comparative Analysis: Crowdfunding vs Venture Capital

The two models have their strengths and weaknesses. Therefore, there’s no definitive answer on which model is superior. Each of them has its applications and purposes.

Speed and accessibility

Crowdfunding campaigns are swift and easy-to-organize endeavours. Typically, platforms that host such campaigns cover all the legal aspects of funding and ROI, which helps startups concentrate solely on delivering on their promises. It is relatively easy to organize a marketing campaign for a startup and gain the initial traction from potential investors.

VC funds, on the other hand, require multi-level agreement, terms negotiations, and stakeholder governance. During economic uncertainties, large funds become especially selective, which can prolong investment approval for months.

Funding Scale and Costs

Crowdfunding can amass up to a six-figure sum. Token-based and debt-based projects can reach several million, but rarely exceed this amount. VC funds rounds typically start from $100k – $ 1 million and can reach tens of millions, becoming mega-rounds.

In terms of costs, crowdfunding campaigns should also cover management fees (platform fees), which can be 5% – 10% of the campaign sum. Yet, the dilution is low and the risk is diffused, but also less controlled. VC investment terms usually include high dilution per investor, a focus on liquidation, and aggressive scaling and expected results.

Risks and Potential Returns

Crowdfunding startups spread the risk across multiple micro-investors. This approach removes dependency on a single backer, which also eliminates governance oversight. Exit liquidity is limited, and returns are modest for the backers.

In the VC case, the upside potential is tremendous. At the same time, startup founders exchange control for scale and must meet the investors’ requirements under strict oversight.

Trends in Regulations and Markets in 2025

Crowdfunding investments are trying to branch out and adopt new formats. For example, blockchain tokenization and smart contracts enhance the liquidity of such startups, helping to build trust in retail investment pools.

VC growth is slow because limited partners are extremely cautious. They prefer cost discipline and consistent profitability over rapid growth. In the current landscape, crowdfunding will need a few more decades to compete with VC investments, and, therefore, LPs can afford such a slow pace.

You can familiarize yourself with a quick summary of the comparative analysis crowdfunding vs venture capital in the table below:

| Decision Point | Crowdfunding (2025) | Venture Capital (2025) |

| Ideal funding range | $10K–$500K (equity/token), $0–$50K (rewards) | ~$100K–$100M+ |

| Near‑term approval cycle | Days to weeks | Weeks to months |

| Investor base | Public + accredited retail | Accredited institutional LPs |

| Control & dilution | Can be spread, but many small owners | Concentrated; VC often gets a board seat |

| Suitability by vertical | Consumer, hardware start-up, small‑scale innovation | Deep tech, AI, biotech, large‑scale scale-ups |

| Trend drivers (2025 estimate) | Social media activation, token models, local/regional democratization | LP caution, AI mega‑rounds, interest‑rate sensitivity |

Choosing the Right Model for Your Startup in 2025

The answer to the question “what model is the best in 2025?” is “the one that fits your startup’s success strategy and goals.” Consider the following criteria before settling on a model:

- Stage of the startup. If your startup is in the pre-production phase, you want to test the MVP with consumers, or need to gain initial traction, crowdfunding is the best approach. If you have a consistent business model ready to be transformed or scaled up, VC funding is a more optimal choice.

- Decide on the market. When it comes to VC funding, it’s best to stick to fields where it is popular. If your startup is in AI, biotech, fintech, or defense tech, VC funding may be your best choice. If your startup focuses on creative products, experimental hardware, or lifestyle, crowdfunding will be more successful.

- Set the priorities straight. Decide what exactly you need from the investments. If you’re focusing on amassing quick funds, community reach out, and narrative control, crowdfunding will be a better option. If there’s no haste, and you want to build a long-term liquidity path, require guidance, or are ready to meet steep VC funds requirements, then roll for the venture capital investments.

Consider these factors, research potential investors, and pick a model that will benefit your startup the most.

Final Words: Crowdfunding vs Venture Capital

Both VC and crowdfunding investments are valid choices for startup development. VC is slower, connected with higher risks and dilution. Yet, it provides the biggest paychecks, especially in the AI and biotech fields. Crowdfunding is more flexible, offers non-equity options, and can quickly gather the necessary funds. On the downside, you can’t expect sums bigger than a couple of million if your startup is lucky. The best investment model is the one that aligns with your project’s current goals and enhances its potential in the long run.

About the Author

Kateryna Moskovenko

Financial Consultant with 14 years of experience in accounting, management accounting, and financial modeling; Founder of Fiscra; Author of courses and trainings in financial modeling, business planning, and entrepreneurship; prepared more than 50 financial models for startups.

Linkedin