Hospital Financial Plan: Optimize with Our Advanced Calculator

Navigating the complexities of healthcare finance requires precision, foresight, and strategic planning. Fiscra’s Hospital Financial Plan page is designed to equip your institution with an advanced calculator tool, enabling you to create, analyze, and refine your financial strategies with unparalleled accuracy. Discover how this essential resource can transform your hospital’s financial planning process.

Why Our Calculator is a Game-Changer

Fiscra’s calculator offers:

Real-Time Financial Modeling: Instantly see the impact of different variables on your hospital’s financial health.

Customizable Scenarios: Tailor financial forecasts to your hospital’s unique circumstances and strategic goals.

Comprehensive Expense and Revenue Analysis: Dive deep into your financial data, identifying opportunities for optimization.

Key Features of the Hospital Financial Plan Calculator

Intuitive Design: User-friendly interface that simplifies complex financial calculations.

Detailed Projections: Generate revenue and expense forecasts with a high degree of precision.

Scenario Analysis: Evaluate the financial outcomes of various strategic decisions.

Risk Assessment Tools: Identify potential financial risks and develop strategies to mitigate them.

How to Use Our Hospital Financial Plan Calculator

Getting started with our Hospital Financial Plan Calculator is straightforward, designed to ensure you can easily navigate through the financial intricacies of healthcare management. Here’s how to use it:

- Input Your Data: Begin by entering your hospital’s current financial data, including prices of services, operational costs, and the amount of necessary investments to start. Our calculator is equipped to handle a wide range of financial metrics, ensuring a comprehensive analysis.

- Analyze the Results: Once your data is inputted, the calculator will provide detailed projections of your hospital’s financial health, including cash flow, profit margins, and debt service coverage ratios. These insights are crucial for strategic planning and decision-making.

- Refine Your Strategy: Use the insights gained from the calculator to refine your financial plan. Experiment with different variables to understand potential risks and opportunities, ensuring your hospital is positioned for financial stability and growth.

Our calculator is designed to be a dynamic part of your financial planning process, adaptable to your hospital’s changing needs and market conditions. By making informed projections and analyses, you’re not just planning for the future; you’re actively shaping it.

=> The detailed guide to using the calculator with images and a detailed description can be found below on this page after the calculator.

Try Now Our Hospital Financial Plan Calculator

Ready to revolutionize your hospital’s financial planning process? Visit our Hospital Financial Plan ( financial model) to access the calculator and start building a more secure financial future today. With Fiscra’s expertise and innovative tools at your disposal, there’s no limit to what your hospital can achieve.

Create a hospital income statement with our calculator: Step-by-step guide

A hospital financial plan calculator streamlines the complex process of financial planning, enabling hospital administrators to manage finances with greater accuracy and foresight. Here’s how to use the calculator effectively:

Step 1: Choose Service Types and Add Prices

Begin by categorizing your hospital services into main types such as outpatient services, inpatient care, emergency services, and specialized treatments. For each category, enter the prices charged for these services. This step forms the basis of your revenue model, estimating potential income from the services offered.

Main Hospital Services Include:

- Doctor’s Consultations: Fees for patient consultations with medical professionals.

- Imaging & Diagnostics: Charges for CT scans, MRIs, ultrasounds, X-rays, etc.

- Lab Tests: Costs for blood tests, urinalysis, infection diagnoses, etc.

- Surgeries: Fees associated with surgical procedures.

- Non-surgical Procedures: Charges for cosmetic procedures, massages, vaccinations, injections, etc.

- Other Services: Any additional services offered by the hospital.

=> This financial model enables the creation of a 3-year financial forecast. Select “Use the same values for 2-nd and 3-rd year” for easier data entry if consistent data is expected.

Step 2: Estimate Patient Volumes

Specify the expected number of patients for each service type, considering both historical data and projected growth. Understanding patient volumes is critical for accurately projecting total revenue and assessing demand for hospital services.

Step 3: Specify Doctors’ Commission

Detail the doctors’ commission as a percentage of consultations and surgeries, encompassing direct expenses related to service delivery. This step is essential for understanding direct costs and calculating net profit.

Step 4: Account for Operating Expenses

Include all fixed monthly operating expenses essential for the hospital’s daily operations, such as payroll expenses, utilities, and marketing.

Step 5: Calculate Initial and Ongoing Investments

Use the calculator to estimate initial investments required for establishing or upgrading the hospital, such as construction, equipment purchases, and technology implementations. Additionally, include ongoing investments for continuous improvement.

Initial Investments include:

- Purchasing or leasing hospital buildings.

- Acquiring medical equipment and technology.

- Developing IT infrastructure and patient management systems.

=> Calculate the total amount of them to enter into the calculator’s initial data.

=> Click the button “CALCULATE” to receive the hospital financial plan with the 3-year forecast.

Step 6: Generate Financial Statements

The calculator automatically generates an income statement, offering a clear view of the hospital’s financial performance, including revenue, expenses, and net profit.

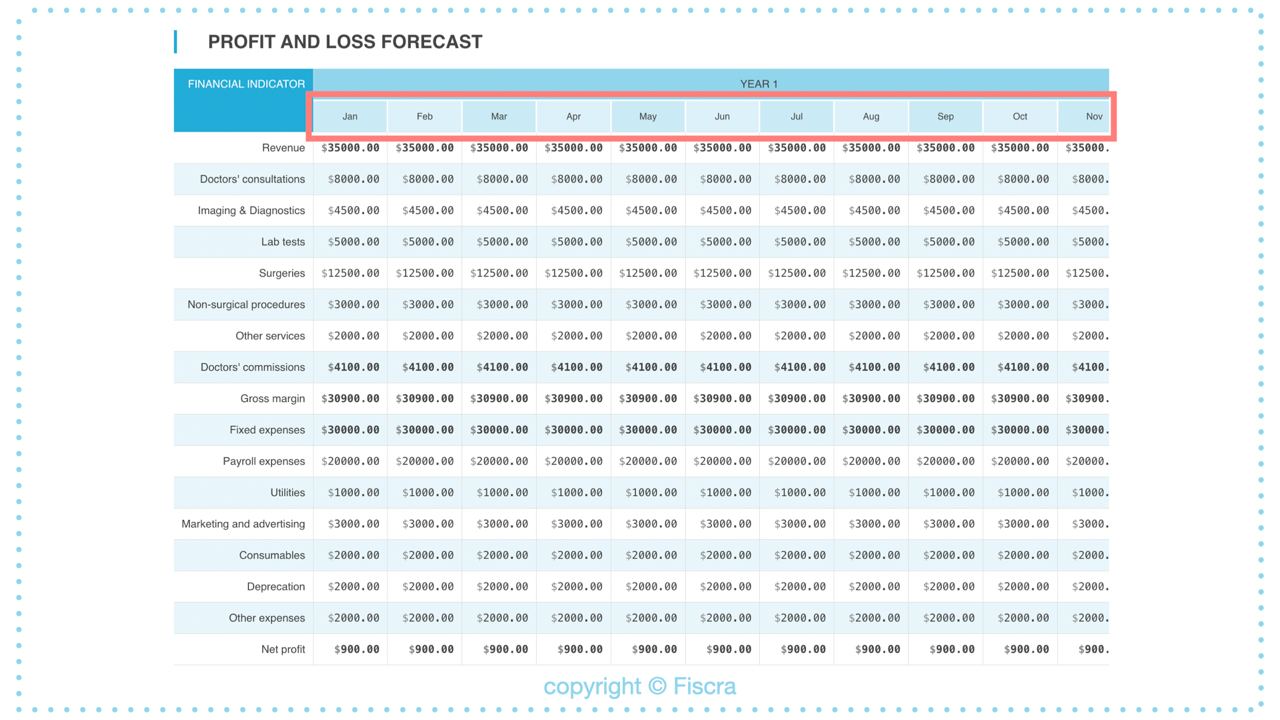

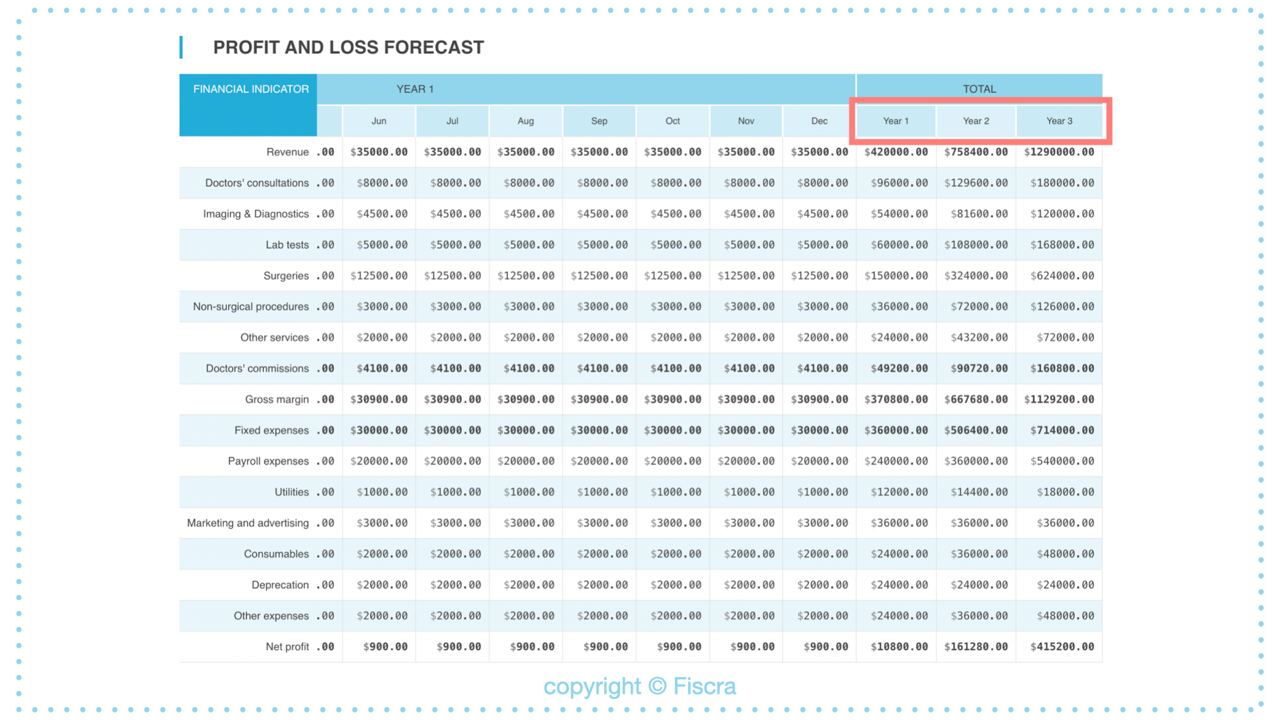

6.1 For the first year the hospital income statement is created with a detailing of the financial data by months:

6.2 At the end of the hospital income statement ( profit and loss forecast) you can see the total financial data (revenue, expenses, and profit) for each of the 3 forecasted years:

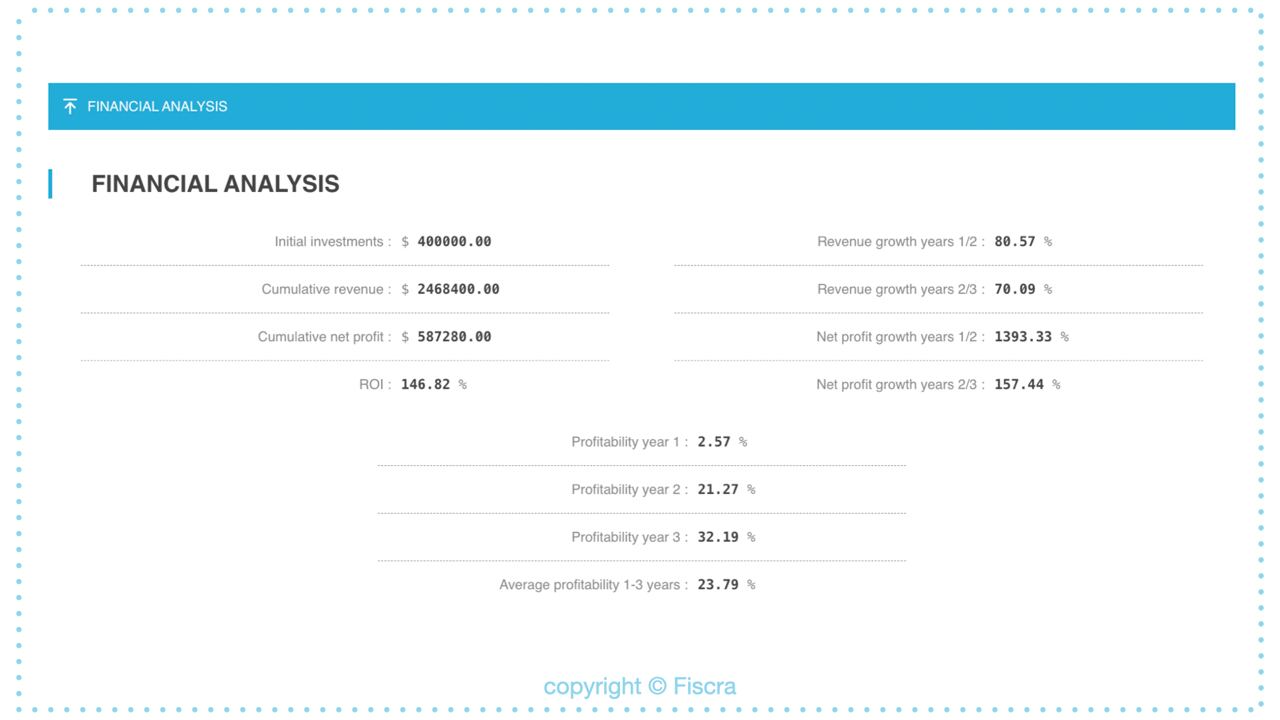

Step 7: Hospital financial analysis

Utilize the generated financial statements and additional calculator features to conduct a thorough financial analysis. This includes reviewing financial ratios, revenue growth, and profitability over the forecast period. Use these insights for strategic planning, identifying areas for improvement, and making informed decisions for financial sustainability.

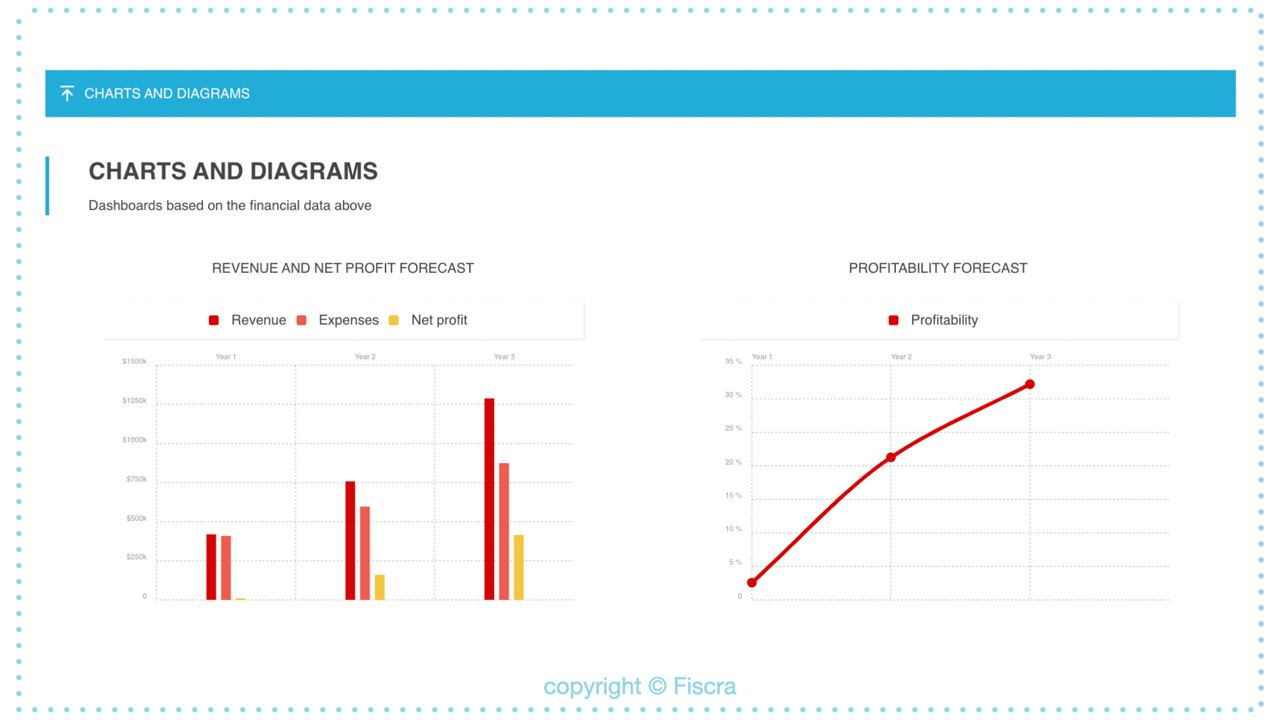

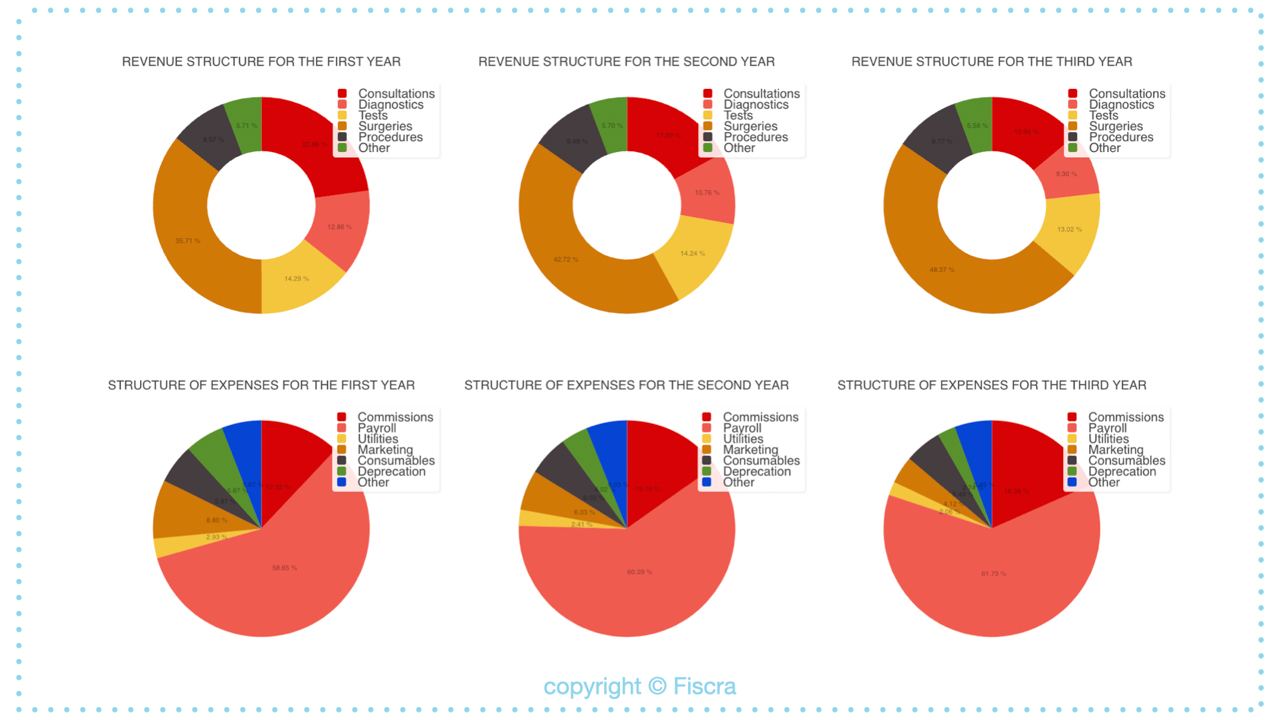

Step 8: Visualizing Financial Data with Charts and Diagrams

The charts and diagrams offered by the Hospital Financial Plan Calculator provide a visual breakdown of revenue sources and expense structures, simplifying complex financial data. These visuals are crucial for swiftly identifying trends, understanding the composition of costs and income, and aiding in the strategic decision-making process.

8.1 Analyze revenue growth, profit, and profitability for the 3 years of the hospital financial plan

8.2 Analyze the structure of revenue and expenses of the hospital financial plan. It will help you to understand what types of goods provide you with the main part of your income. At the same time, you will understand that types of expenses are the most significant for your business.

Step 9: Review and Refine Financial Projections

Finally, critically assess the financial plan for any unrealistic assumptions or potential errors. The calculator allows for easy adjustments to data inputs, enabling you to refine your financial projections to better align with the hospital’s strategic goals and the evolving healthcare landscape.

=> Click the back arrow to update the initial data:

By following these steps with a hospital financial plan calculator, healthcare administrators can develop a detailed and actionable financial plan. This plan not only aids in financial management but also supports strategic decision-making, ensuring the hospital’s ability to provide quality care while maintaining financial health.

Frequently Asked Questions for Hospital Financial Plan Calculator

What is a Hospital Financial Plan Calculator? A Hospital Financial Plan Calculator is an online tool designed to help hospital administrators and financial planners create detailed financial forecasts. It simplifies the calculation of revenue, expenses, and net profit by allowing users to input data related to services offered, patient volumes, costs, and more.

Who can benefit from using this calculator? Hospital administrators, financial officers, and management teams can benefit from using this calculator. It’s particularly useful for those involved in strategic planning, financial management, and operational efficiency in healthcare settings.

How do I calculate doctor’s commissions using this calculator? Doctor’s commissions can be calculated by entering the percentage of service prices that are allocated as commissions for doctors. This percentage is applied to the revenue generated from each service to calculate the total commission.

Can the calculator help with long-term financial planning? Yes, the calculator is equipped to assist with long-term financial planning by providing a 3-year financial forecast. Users can input expected data for services, costs, and patient volumes to project financial performance over the coming years.

How does the calculator handle different types of hospital services? The calculator allows users to categorize hospital services into various types, such as surgeries, diagnostics, lab tests, and more. Users can input specific prices and volumes for each service type to accurately forecast revenue.

What kind of financial statements does the calculator generate? The calculator generates comprehensive financial statements, including an income statement (Profit and Loss Statement), which highlights gross profit, total operating expenses, and net profit or loss.

Is it possible to adjust the financial plan once it’s been created? Yes, the calculator allows for easy adjustments to the financial plan. Users can update data inputs at any time to refine their financial projections, making it a flexible tool for dynamic financial planning.

How important are charts and diagrams provided by the calculator? Charts and diagrams are crucial for visualizing financial data, making it easier to understand trends, revenue growth, profitability, and the distribution of expenses. They play a vital role in simplifying complex financial information for strategic analysis.

Can I use this calculator for a new hospital or healthcare facility? Absolutely. The calculator is designed to be useful for both established hospitals and new healthcare facilities in the planning stages. It helps in estimating initial investments, projecting revenue, and determining financial viability.

Where can I access the Hospital Financial Plan Calculator? The Hospital Financial Plan Calculator is available online on this page. It can be accessed through financial planning websites, healthcare management platforms, or specialized financial tools designed for the healthcare industry.