Free Online financial model for service business

Navigating the financial complexities of a service business can be challenging. That’s where fiscra.com offers a specialized Financial Model for Service Business. Our tool is engineered to help service-based enterprises accurately forecast financial performance, manage cash flow, and strategize for growth.

Why Our Financial Model For Service Business?

Tailored to Service Businesses: Whether you operate in consulting, marketing, IT services, or any other service industry, our model is designed for your unique needs.

Comprehensive Financial Forecasting: Our model covers all bases from revenue predictions to expense tracking, enabling you to make informed decisions.

Strategic Growth Planning: Utilize our model to identify key financial levers in your business, optimizing for profitability and scalability.

Using Our Financial Model For Service Business

Getting started with our financial model is straightforward. Input your service business’s specific data, including service offerings, pricing strategies, and operational expenses. Our tool will then generate detailed financial projections, highlighting opportunities for optimization and growth. A detailed explanation of how to use the calculator you can find below on this page.

Key Features of Our Financial Model For Service Business

Customizable Inputs: Tailor every aspect of the model to fit your service business’s unique profile.

Dynamic Projections: Gain insights into your financial future with projections for revenue, costs, and profitability.

Decision Support: Use our model to test different scenarios and their financial outcomes, guiding your strategic decisions.

Ready to take your service business to the next level? Explore our Financial Model for Service Business today and start building a more prosperous tomorrow.

How to Create an Income Statement for Service Business in a Few Minutes with Our Calculator?

Let’s explore how to swiftly create an income statement for your service business using our online financial model calculator. This tool is specially designed to demystify financial documentation, enabling you to input data effortlessly and generate an accurate depiction of your business’s financial status.

STEP 1: Choose the Main Types of Services and Input Prices of Services

Start by entering the prices of the services your business offers. This step lays the foundation of your revenue model, setting the stage for calculating potential income based on the value assigned to each service provided.

=> The following types of services are represented in this online financial model for service business:

- HOURLY FEE. This service is used for hourly payments by clients.

- MONTHLY FEE. This type of service can be used for monthly subscriptions for constant clients.

- OTHER SERVICES. It can be any service that you need to provide.

=> This financial model for service businesses can be used for the creation of 3 years financial forecast. If you plan to use the same data ( prices, volume of sales, amount of expenses), click “Use the same values for 2-nd and 3-rd year” to simplify entering the initial data ( assumptions).

STEP 2: Add Sales Volume

Next, specify the sales volume for each service. This involves estimating or inputting the number of units sold for each service within a given period. Understanding the volume of services sold is crucial for projecting total revenue and assessing market demand.

STEP 3: Specify Cost of Sales:

If applicable, detail the cost of sales as a percentage of the service price. This percentage helps in determining the direct costs associated with providing each service, crucial for calculating the gross margin by revealing the true cost of delivering your services to customers.

The cost of sales for service businesses comprises the direct expenses associated with delivering the services to clients.

=> It is calculated as a percentage of prices in this online financial model for service business.

COST OF SALES = SELLING PRICE * % OF DIRECT EXPENSES

=> If you have no direct expenses in your service business, you can use this field in this online financial model for service business for sales commissions or discounts.

STEP 4: Calculate Monthly Expenses

Incorporate all operating expenses related to running your business, such as salaries, rent, utilities, and marketing costs. The calculator categorizes these expenses, ensuring comprehensive coverage of your operational costs.

Fixed monthly expenses for a service business are the recurring costs that must be paid regularly, regardless of the number of client projects or the income generated.

=> These expenses typically include:

- office lease

- Utilities (electricity, water, internet)

- Salaries and benefits for a team with monthly rates

- Software subscriptions

- Advertising and marketing costs

- Other administrative expenses.

STEP 5: Calculate Initial Investment

Include the total amount of initial investment necessary to start your service business in the financial model for service business calculator. It is necessary for the ROI calculation by the calculator.

Initial investments for a service business refer to the upfront costs necessary to start and set up the business.

=> These expenses typically involve:

Initial investments for a service business refer to the upfront expenditures necessary to establish and set up the business.

- Buying office space (if applicable)

- Purchasing office equipment (laptops, printers, mobile phones, etc)

- Creating a website

- Furnishing the office

- Licenses and permits.

=> Please provide the total amount of your initial investment requirements for launching the service business and enter it in the “initial investments” field of the online financial model for a service business.

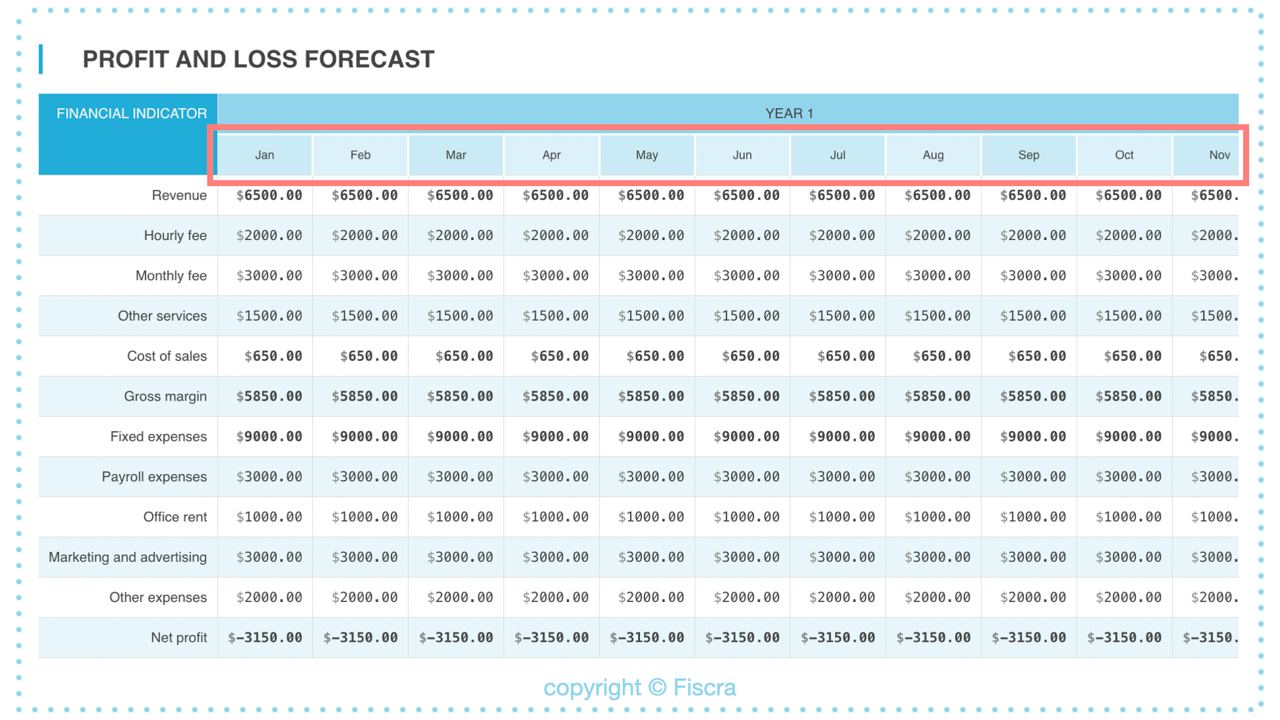

STEP 6: Generate Your Income Statement ( Profit and Loss Forecast)

With all data in place, the calculator instantaneously produces an income statement. This document offers a snapshot of your net income by deducting total expenses from total revenue, highlighting gross profit, total operating expenses, and net profit or loss.

6.1 For the first year the financial forecast is created with a detailing of the financial data by months:

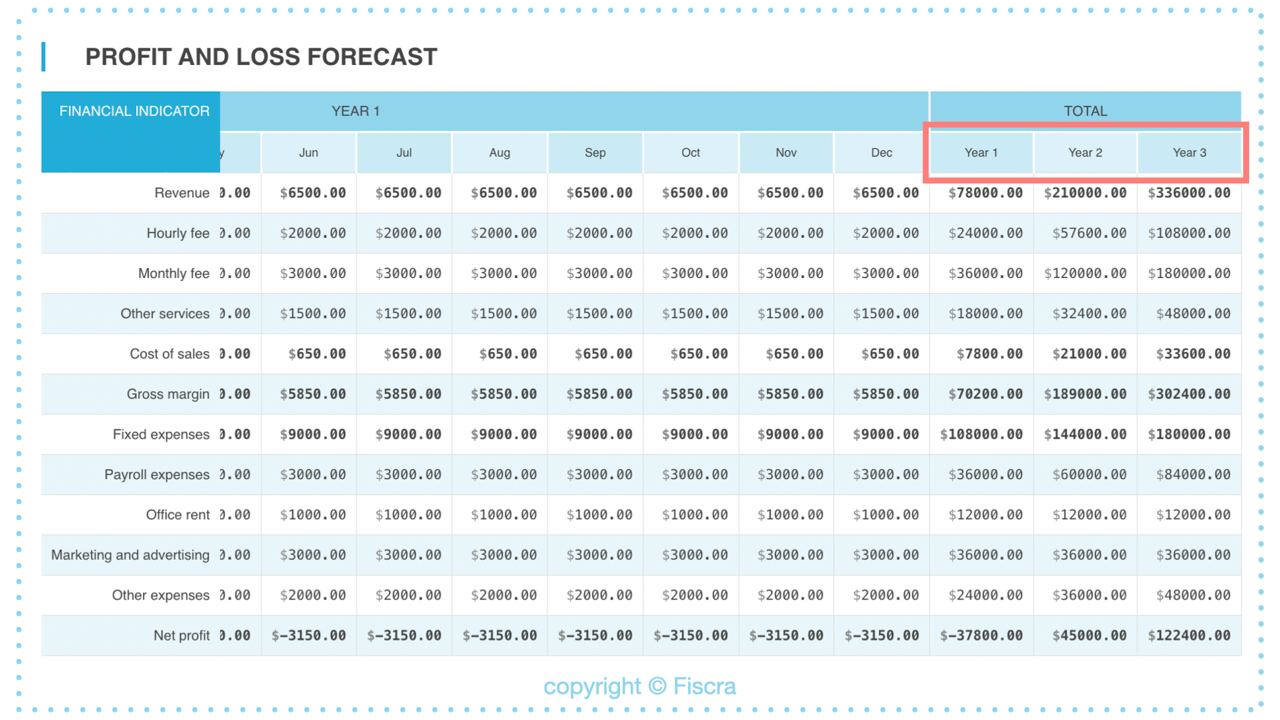

6.2 At the end of the income statement ( profit and loss forecast) you can see the total financial data (revenue, expenses, and profit) for each of the 3 forecasted years:

STEP 7: Analyze Financial Data

Based on the created income statement financial analysis is available below with key financial ratios. These ratios will help you evaluate financial performance and identify cost-saving opportunities, avenues for revenue enhancement, and strategies to fortify profitability.

Let’s explain the main financial ratios used in the financial model for service business calculator:

Revenue from a service business is the total income received from providing the services to clients. It is all money earned from the business for a certain period of time before excluding any expenses.

The revenue is calculated by multiplying the services’ selling prices by the number of services sold.

REVENUE = SELLING PRICE * SALES VOLUME

That is why you need to add the prices of services and quantity of sales to this calculator’s initial data to have the possibility to calculate the revenue.

Net profit for a service business represents the remaining earnings after all expenses, including the cost of sales, fixed monthly expenses, and other operating costs, have been deducted from the total revenue.

=> Net profit is a vital indicator of the business’s profitability and financial health. You can find its calculation in the profit and loss forecast section of this online financial model for service businesses.

ROI (Return on Investment): This ratio evaluates the efficiency of an investment in the service business.

ROI is calculated by dividing the accumulated net profit received from the service business by the total amount of the investment. A higher ROI indicates a more profitable business relative to its investment costs.

ROI should be higher than 100%, which means that money earned from the service business is more than the investment spent to start and support the service business.

In this financial model for service business ROI is calculated as the proportion of forecasted net profit for 3 years to the amount of the initial investment.

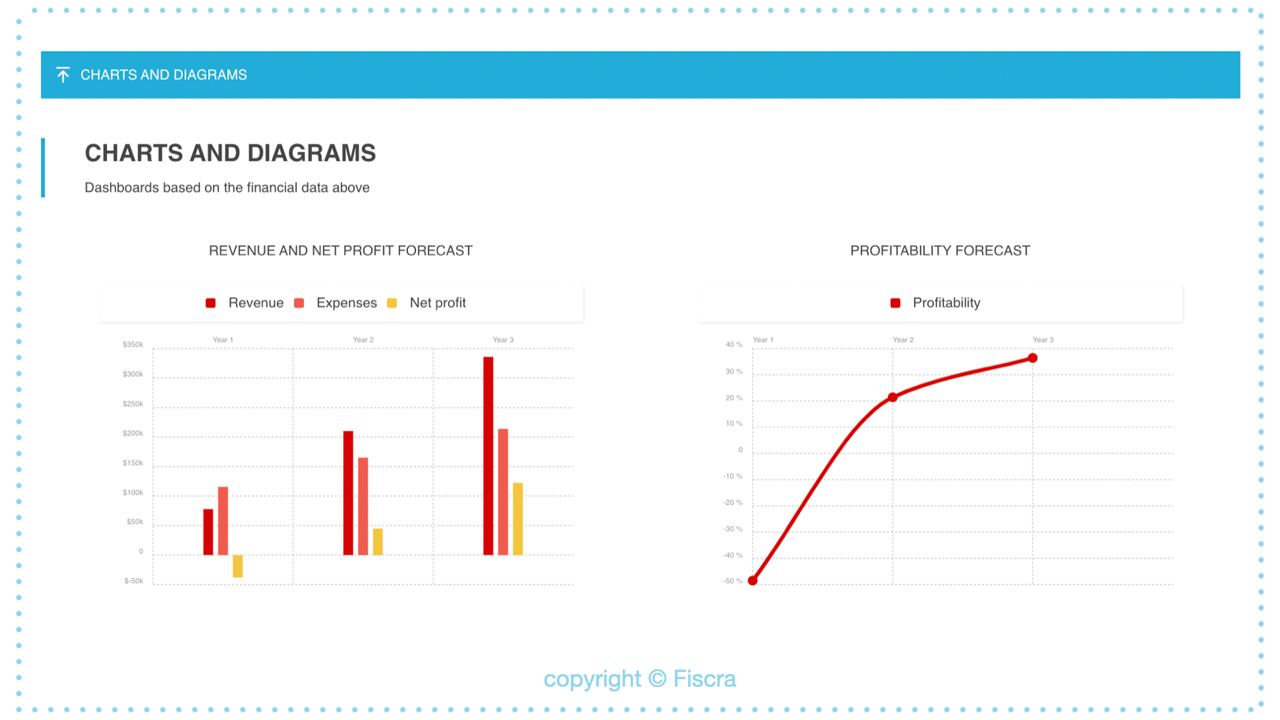

Profitability ( Profit margin): Expressed as a percentage of net profit to the revenue, profitability measures a service company’s ability to generate earnings as compared to its expenses and other relevant costs incurred during a specific period.

These financial ratios derived from the service business financial model calculator are essential for any service-oriented business looking to analyze its financial performance comprehensively. They not only provide a snapshot of current financial health but also help in forecasting future financial scenarios, enabling strategic planning and informed decision-making for sustainable business growth.

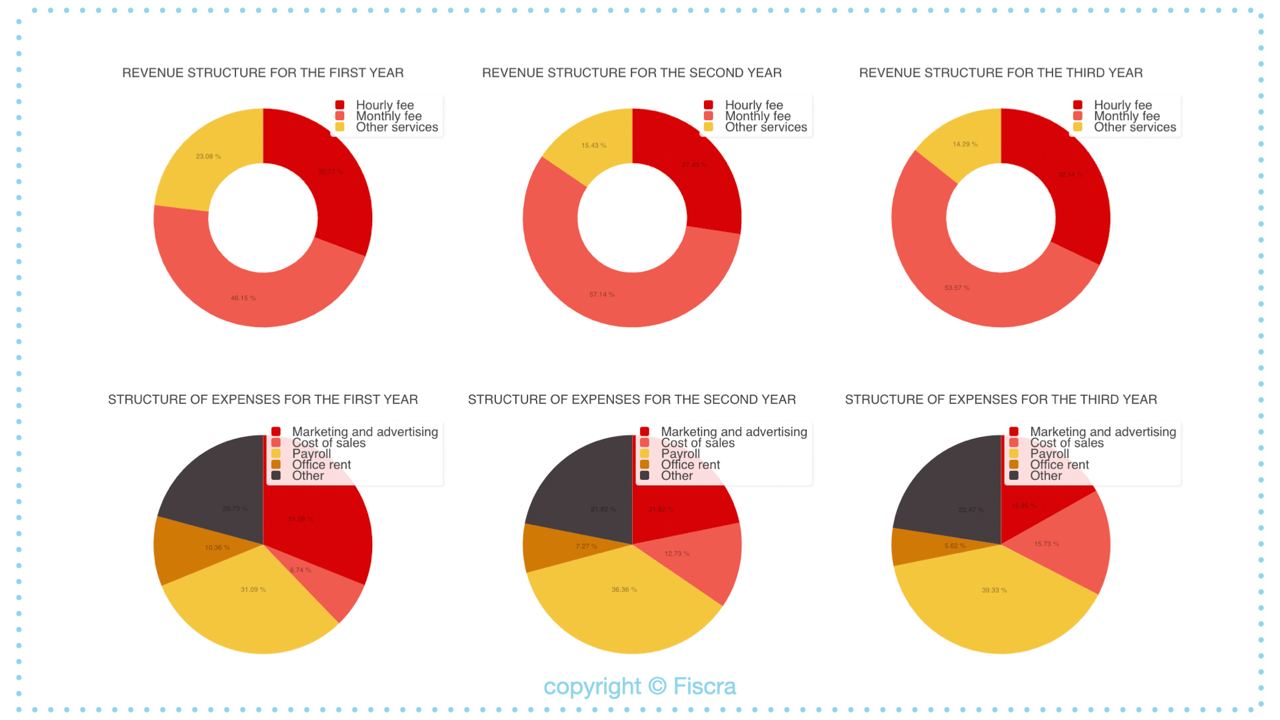

STEP 8: Study Charts and Diagrams

Simplify your understanding of the financial data by studying the provided charts and diagrams.

8.1 Analyze revenue growth, profit, and profitability for the 3 years of the financial forecast

8.2 Analyze the structure of revenue and expenses. It will help you to understand what types of services provide you with the main part of your income. At the same time, you will understand that types of expenses are the most significant for your business.

STEP 9: Review and Update Initial Data of the Financial Model for Service Business

If necessary, you can easily review and update your initial data just by clicking the back page arrow. This feature allows for seamless adjustments to prices, sales volumes, or costs, enabling you to refine your financial projections and ensure they remain aligned with your business’s evolving circumstances.

=> Click the back arrow to update the initial data:

Our online financial model calculator simplifies the creation of an income statement for service businesses, facilitating time-efficient and accurate financial analysis. Whether assessing the current financial landscape or planning for future endeavors, this tool provides the essential financial insights needed to guide your business toward sustained growth and success.