Financial Modeling Services for Startups

Gain a clear and comprehensive financial roadmap for your startup. Evaluate your enterprise’s critical financial indicators, encompassing revenue projections, profitability thresholds, and operational expenditures. Gain insights to make beneficial moves, avoid pitfalls, and present your startup to investors confidently with Fiscra’s financial modeling services for startups. Additionally, if you require ongoing support, we offer a comprehensive range of financial and accounting services.

Format: Creating a financial model with a client during an online meeting or preparing the model based on provided initial data.

Time: up to 10 hours.

Results: A comprehensive financial model of the project for the following three years.

FINANCIAL MODEL

Ideal For Startups in the Seed and Growth Stages

You’ve successfully pitched your idea and secured initial funding, but what’s the next step? Financial modeling services help evaluate an optimal trajectory for business development and identify key financial indicators, including optimal burning rates, for startups.

Financial models by Fiscra are tailored for startups in early and development stages. You can confidently navigate the market, take the risks, and explore different growth scenarios with a precise financial model at your fingertips.

When you are aware of the break-even point and have a consistent development plan, you can shift your focus from avoiding financial hardship to executing your vision. Finally, backed by a solid financial model, your pitch evolves from a promise into a potential partnership —a strategic advantage in the modern, dynamic market.

Avoid Costly Mistakes: Why You Need Financial Modeling Consulting

A well-established financial model is one of the cornerstones of any startup’s success. With a sound financial model, you’ll be able to assess the risks, calculate profits, and build a fail-proof roadmap of your project’s evolution. With a model in place, you can:

Most importantly, a financial model allows you to stay in control by comparing actual results with your plan — and adjusting course as needed.

You can also test different business scenarios by adjusting prices, sales volume, or product lines to achieve optimal profitability. You will have a clear view of key metrics, including payback period, profit margin, and ROI.

Additionally, a financial model allows for effective control by comparing actual results with planned figures, helping businesses stay on track and adapt quickly.

What’s Included in Financial Modelling Consulting Services for Startups

Financial modeling services include the following:

Financial Forecasting – Profit & Loss Report

Get accurate forecasting of your company’s fiscal health while proactively addressing potential challenges.

- Future revenue estimation based on current activities.

- Expected costs of goods and services calculations.

- Operational expenses calculations.

- Prediction of profits and losses from the project.

A pre-launch financial analysis determines whether your project demonstrates fiscal sustainability or requires strategic recalibration for success.

- Calculates the project’s payback period

- Estimates total profit over time

- Measures the financial upside of sales and investments

- Determines the breakeven point

- Tests if the business idea is financially viable

Cost-benefit analysis assesses if your project makes financial sense and how soon it can become profitable, helping you make go/no-go decisions.

- Enables analysis of initial funding prerequisites

- Forecasts future cash needs for smooth operations

- Constructs a detailed liquidity statement for monitoring capital receipts and disbursements chronologically

Cash flow planning and management will help prevent cash shortages and improve financial stability by showing when and how much money will move through your business.

Advantages of Financial Model Consulting

When you choose financial modeling from Fiscra, you’re entitled to several advantages

Clear financial insights

Confidence before Commitment

Speak the Language of Investors

Forecasting & Market Understanding

Tracking performance

Interesting Facts about Financial Modeling

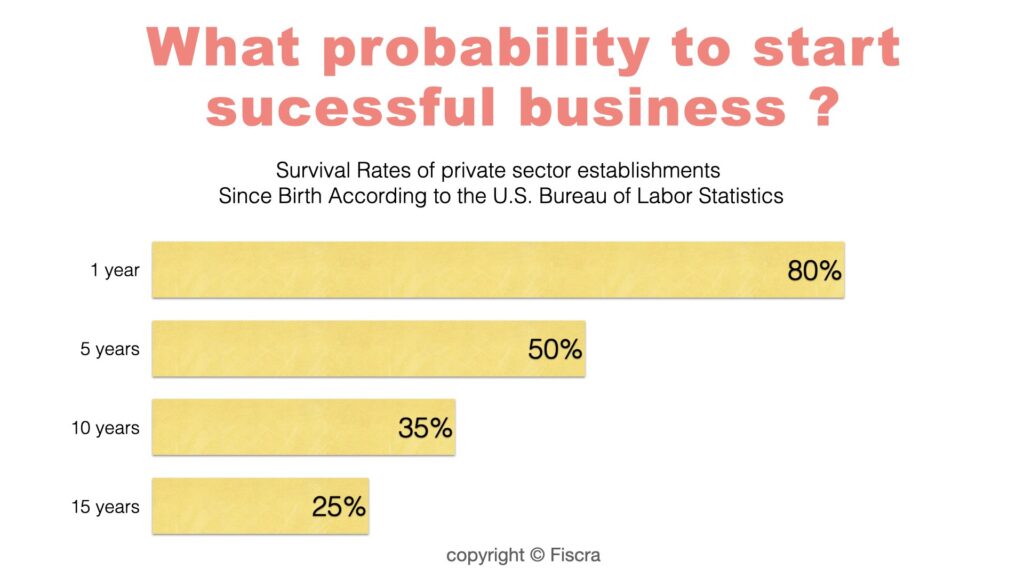

Financial modeling is an integral part of a successful business. Whether it is a startup or a large company, a solid model will help to deal with any upcoming challenges, unexpected expenses, and search for funding. In fact, financial modeling is critical for new companies and startups. 20% of startups fail in their first year, and only 50% survive the five-year mark.

If you wish to secure the future of your business and see it flourish, Fiscra can provide you with professional assistance in building a lasting model that will help you survive rough patches.

Financial models also contribute to saving time and resources long before a serious commitment. When a new business is driven by passion, it is easy to lose the scope and focus in the strive to achieve results as quickly as possible. A financial model helps predict possible pitfalls and chart a solid and grounded development roadmap for your business’s success. The model can also reveal prospects of the business and how well it will perform under different circumstances.

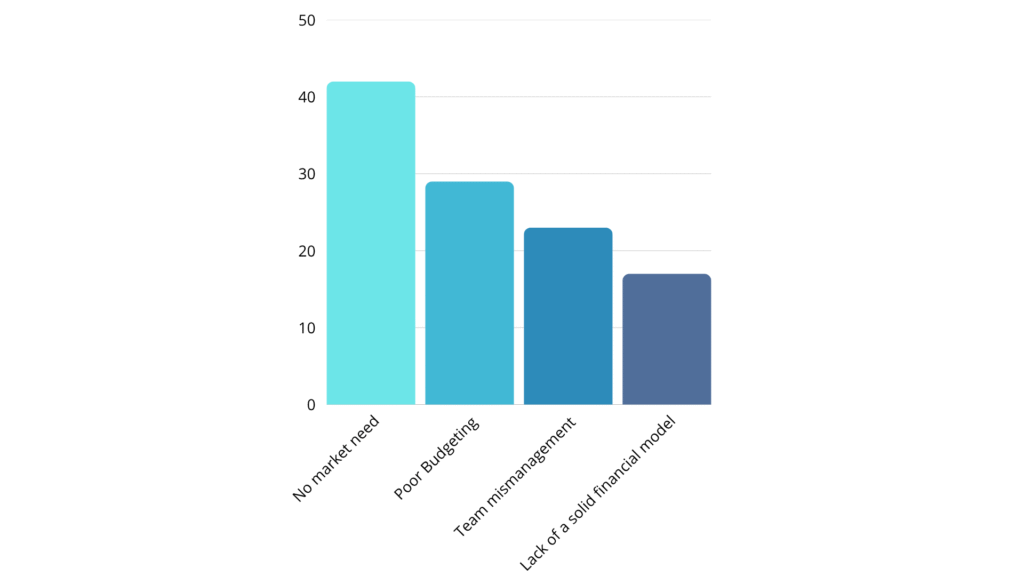

Most Common Reasons why Startups Fail, according to Statista

Many companies cross the fifteen-year survival mark due to rigorous planning and precise financial modelling. Do not hesitate to build your road to a prosperous future today.

Many companies cross the fifteen-year survival mark due to rigorous planning and precise financial modelling. Do not hesitate to build your road to a prosperous future today.

Steps of how the Financial Modeling Consultant Services Work

Step 1: Submit a Request

Please fill out the consultation request form on our website or contact us via WhatsApp or Telegram at +380 66 996-45-05. This is the first step in beginning to work with us.

Step 2: Schedule Confirmation

We will contact you within 24 hours after receiving your request. During the call, we’ll answer your initial questions and confirm the date and time for your consultation.

Step 3: Payment

A prepayment is required within 3 days of booking your consultation. If payment is not received within this period, the reservation will be canceled.

Step 4: Consultation

Once full payment is received, the consultation will take place at the scheduled time.

Cost of Financial Modeling Services for Startups

The service price range is $500 – $1,000. Fixed upfront, no hidden fees. What’s included:

- Triannual financial projection framework

- Liquidity trajectory assessment for solvency management

- Income and expenditure forecast with interpretive review

- Financial metric evaluation for organizational effectiveness

- Contingency modeling for risk mitigation and strategic optimization